Biotech in LATAM: From Biodiversity to Global Impact

Biotechnology, commonly referred to as biotech, is an emerging field which uses technology to engineer biology into products and services. It includes genetic engineering, cell therapy, and bioinformatics, which can enable advancements in drug development, disease treatment, sustainable agriculture, and renewable energy, amongst others.

Over the past decade, breakthroughs in these fields have set the stage for what experts are calling the 'Bio Revolution.' This paradigm shift promises to fundamentally transform how industries operate, ushering in a new era of biological innovation. In 2020, McKinsey estimated that this ‘Bio Revolution’ could have a $2 to $4 trillion dollar worldwide impact between 2030 and 2040, equivalent to 6.5–13 times Chile’s annual GDP1.

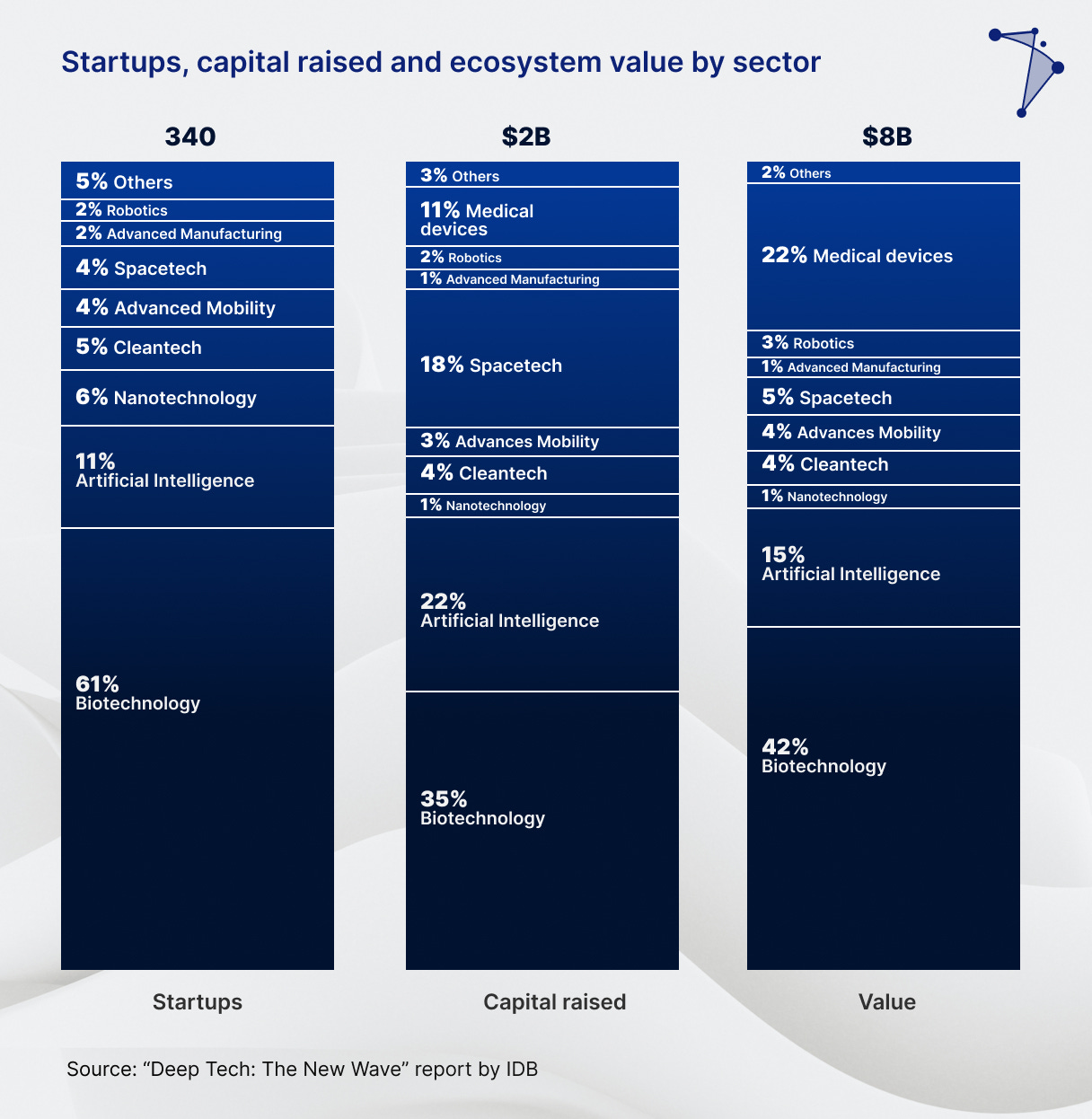

On a regional level, biotech has become a leading force in Latin America’s Deep Tech sector. According to the Interamerican Development Bank, the sector represents 61% of startups backed by institutional investors in Latin America (LATAM), accounting for 35% of the total capital raised and 42% of the ecosystem’s total value)2.

What unique attributes make the region so appealing for biotech investments? Which LATAM countries stand out in this race? And who are the key players driving innovation? In this blog, we explore these questions and uncover why biotech is poised to reshape Latin America’s deep tech landscape.

Key Drivers Behind Latin America’s Biotech Momentum

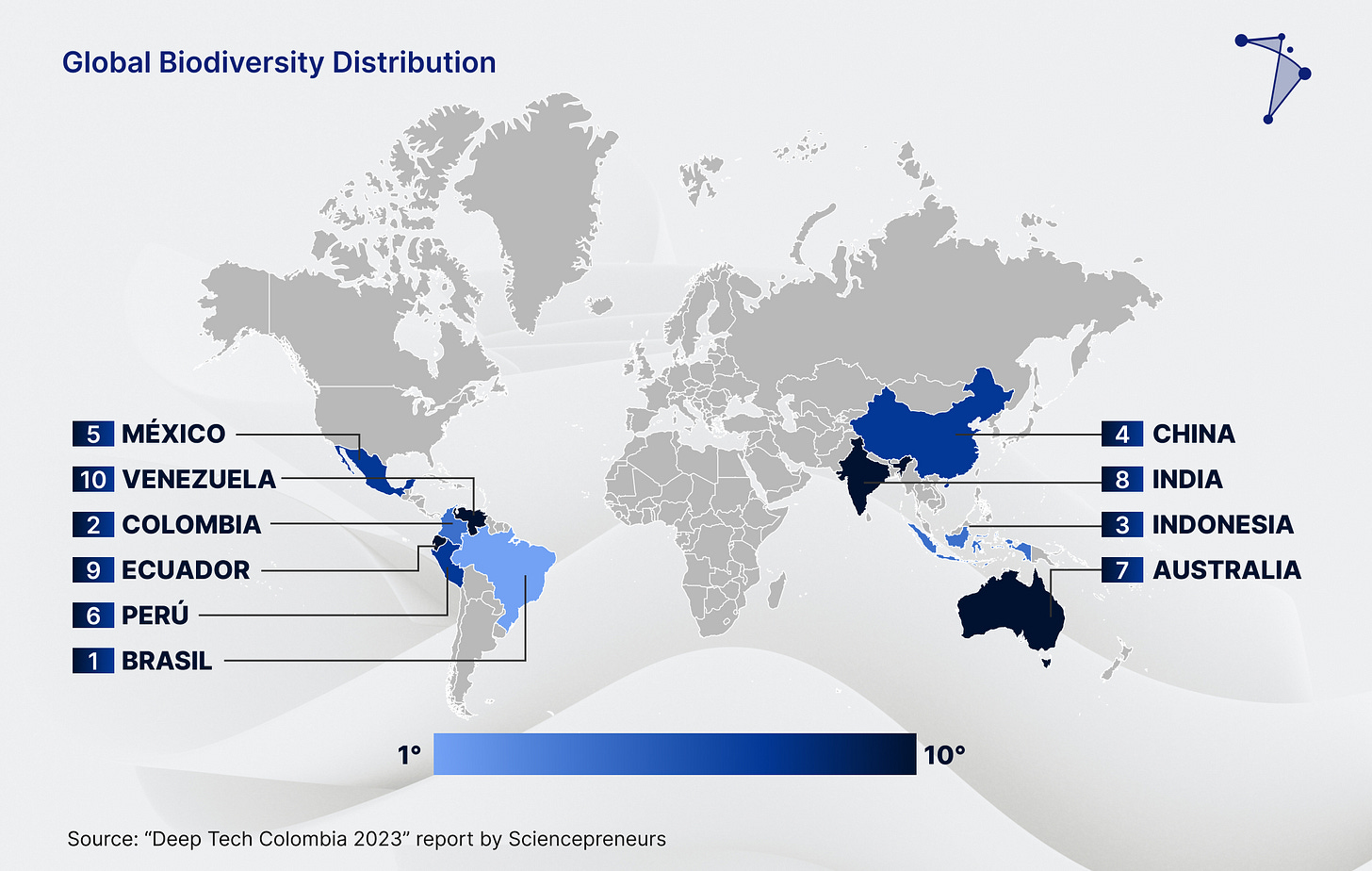

There are several factors that explain why biotech is poised to remain a prominent field in LATAM. First, the region’s historical ties to food and agriculture, coupled with its vast biodiversity, create fertile ground for innovation. LATAM is home to 40% of the world’s biodiversity and 11 of the 14 recognized biomes, with six countries (Brazil, Colombia, Ecuador, Mexico, Peru, and Venezuela) ranking among the 17 “megadiverse” nations worldwide3.

Another critical factor driving biotech’s growth in Latin America is the availability of highly skilled professionals across core life science disciplines—ranging from Biology and Genomics to Biochemistry, Medicine, and Agricultural/Veterinary Sciences.

A 2022 report published by Zentynel, one of the only 15 regional funds focused on Deep Tech in LATAM, highlighted “the impact that the publications of scientific papers from Latin America in life sciences are having”, and also the relatively cheap cost of human capital in LATAM compared to more developed countries: the average salary of professionals related to life sciences in Latin America is 35% lower than that of Europe and 65% lower than that of the United States4.

Finally, governments across LATAM actively foster biotech through strategic policies and public investment. Argentina’s 2017 Interministerial Agreement for Bioeconomy Development, Brazil’s designation of Bioeconomy as a core focus under its National Strategy for Science, Technology, and Innovation, and Chile’s alignment of intellectual and industrial property regulations with global standards—backed by agencies such as CORFO and the Scientific and Technological Development Promotion Fund—all illustrate the region’s commitment to nurturing its biotech ecosystem.

Biotech presence across the region

According to the IDB, biotech leads most of the Deep Tech activity in LATAM and also represents the largest share of its Deep Tech ecosystem value. However, the sector’s prominence varies by country.

Below is a snapshot of the most relevant biotech-focused nations in the region, per the IDB:

Costa Rica:

Of the 6 Deep Tech startups that have received VC funding, 83% focus on biotech.

Three companies—Clearleaf, Speratum, and Cenibiot—are each valued at $10–25 million USD.

Chile:

Of the 65 Deep Tech startups that have received VC funding, 52% focus on biotech.

Standouts include Phage Lab, a developer of bacteriophage treatments for animals5, valued at $100–500 million USD, and Thyroid Print, a molecular tester for indeterminate thyroid nodules6, valued at $50–100 million USD.

Brazil:

Of the 101 Deep Tech startups that have received VC funding, 57% focus on biotech.

Kaiima, a company developing plant genetics and breeding technology7, is valued at $100-500 million USD.

Biotimize, a provider of research, technology, development, and other services for biopharma sector8, is valued at $100-500 million USD.

Argentina

Of the 103 Deep Tech startups that have received VC funding, 67% focus on biotech.

Bioceres, a provider of crop productivity solutions to growers based in Argentina, is valued at $0.5-1 billion USD.

Moolec, a producer of animal proteins in plants, and Stämm, a producer of biologics & cell therapies, are valued at $100-500M each.

Mexico

Of the 103 Deep Tech startups that have received VC funding, 74% focus on biotech

Eva is valued at $50–100 million USD, while Agrorganica and Polybion each range from $25–50 million USD in valuation. PROSPERiA is valued at $10–25 million USD.

Uruguay

Of the 11 Deep Tech startups that have received VC funding, 90% focus on biotech.

Ecosativa, Enteria, Germinar and BentenBiotech, all biotech startups based in Montevideo, are valued at $1-5 million USD .

It’s worth noting that most Uruguayan startups are still in the early stages of development–none of them have a 10+ million USD valuation.

Investing in biotech

As with every other sector, biotech has a particular set of trends to consider when making investment decisions. Zentynel’s 2022 “Biotech in Latin America: The Next Frontier” report9 points out that it demands significantly higher investment and longer timelines than most other industries, primarily due to mandatory testing and certification requirements. At the same time, the global nature of biotech innovations often means they have worldwide applicability.

Below are the principal factors that shape investments in biotech-based ventures worldwide, subsequently 3 trends for biotech investment specifically in LATAM identified by Zentynel, and finally a map of VCs actively investing in biotech.

Principal investment factors worldwide

Distinct Market Risks

Unlike many technology startups that face high risk tied to customer adoption, biotech ventures typically focus on securing commercial distribution agreements and guarding against potential substitutes.

Stage-Dependent Investment Risks

Early-stage projects carry risks linked to the underlying technology and intellectual property strategy. As projects advance, risk centers on fulfilling rigorous testing and certification milestones.

Crucial Role of IP Protection

Safeguarding intellectual property is essential for capturing the value generated throughout research, development, and testing.

Deep Sector and Technological Expertise

A thorough understanding of biological sciences and biotech business models is key to assessing solution applicability, technological novelty, and navigating complex regulatory approval processes.

The absence of specialized investors capable of evaluating these factors makes it very challenging for companies to raise rounds of between $2-$7 million USD, according to Zentynel.

Investment trends in LATAM

No single fund is currently dominating the biotechnology sector, with major players like Kaszek and Monashees participating only on an opportunistic basis.

The early-stage investment landscape is thriving, thanks to new players focusing on seed-stage companies, which bodes well for a strong deal-flow in later funding rounds.

Co-investment is on the rise, with nearly 70% of funding rounds involving multiple investors. This trend highlights a growing interest among funds to collaborate, which could support the emergence of a leading player in the biotechnology space.

Distribution of biotech VC Funds in LATAM

About LADP

At LADP, we are working to identify, participate in, and foster Deep Tech networks of startups and builders across LATAM. Our mission is to address challenges related to institutional frameworks, education systems, infrastructure limitations, and market environment paradigms that currently hinder large-scale by systematically adopting and implementing international best practices in ecosystem.

https://publications.iadb.org/en/deep-tech-new-wave

https://publications.iadb.org/en/deep-tech-new-wave

https://www.caf.com/es/actualidad/noticias/cop16-la-biodiversidad-une-a-america-latina-y-el-caribe

https://zentynel.com/wp-content/uploads/2022/10/BROCHURE-ZENTYNEL_ENG.pdf

https://platform.tracxn.com/a/d/company/04anjYVNA-fOitU-m4KoVGhket0Nd9DuTes81nLmqhI/phage-lab.com#a:key-metrics

https://www.thyroidprint.com/pacientes/thyroidprint?locale=en

https://platform.tracxn.com/a/d/company/GWOodn0QLOmFIJUIEexUqb5u0_lDJRfHhPnm_l4wIVQ/kaiima.com#a:key-metrics

https://platform.tracxn.com/a/d/company/c9KzBr4fnZFAenmMoU6TDN4dUYVpGrPV5ZSTaGUoH3Y/biotimize.com.br#a:key-metrics

https://zentynel.com/wp-content/uploads/2022/10/BROCHURE-ZENTYNEL_ENG.pdf