Catalyzing Innovation: The Deep Tech investment landscape in LatAm

Over the last few years, deep tech has rapidly emerged as one of the most promising and transformative sectors in Latin America and the Caribbean (LAC). Investment in cutting-edge science —ranging from advanced biotechnology to clean energy solutions— continues to grow. However, developing these technologies requires in-depth work on the technology itself to make it functional, substantial research and development efforts, and historically, massive capital deployment over long periods.

Therefore, key questions remain: Who’s investing in these high-potential companies? How much is being invested? And what areas within deep tech appear most attractive to decision-makers?

How much is being invested

By 2023, institutional investment raised by deep tech companies in LAC reached USD 2 billion, encompassing the 340 startups mapped in the Deep Tech: The New Wave report by the IDB1.

While this figure is far below the USD 13 billion invested in deep tech in Asia, the USD 14 billion in Europe, and the USD 52 billion in the United States as of September 20242, it represents significant progress for the region.

Notably, investment in LAC increased by nearly 600% between 2019 and 2023—rising from under USD 300 million to USD 2 billion in just four years. This growth trajectory shows no signs of slowing down:

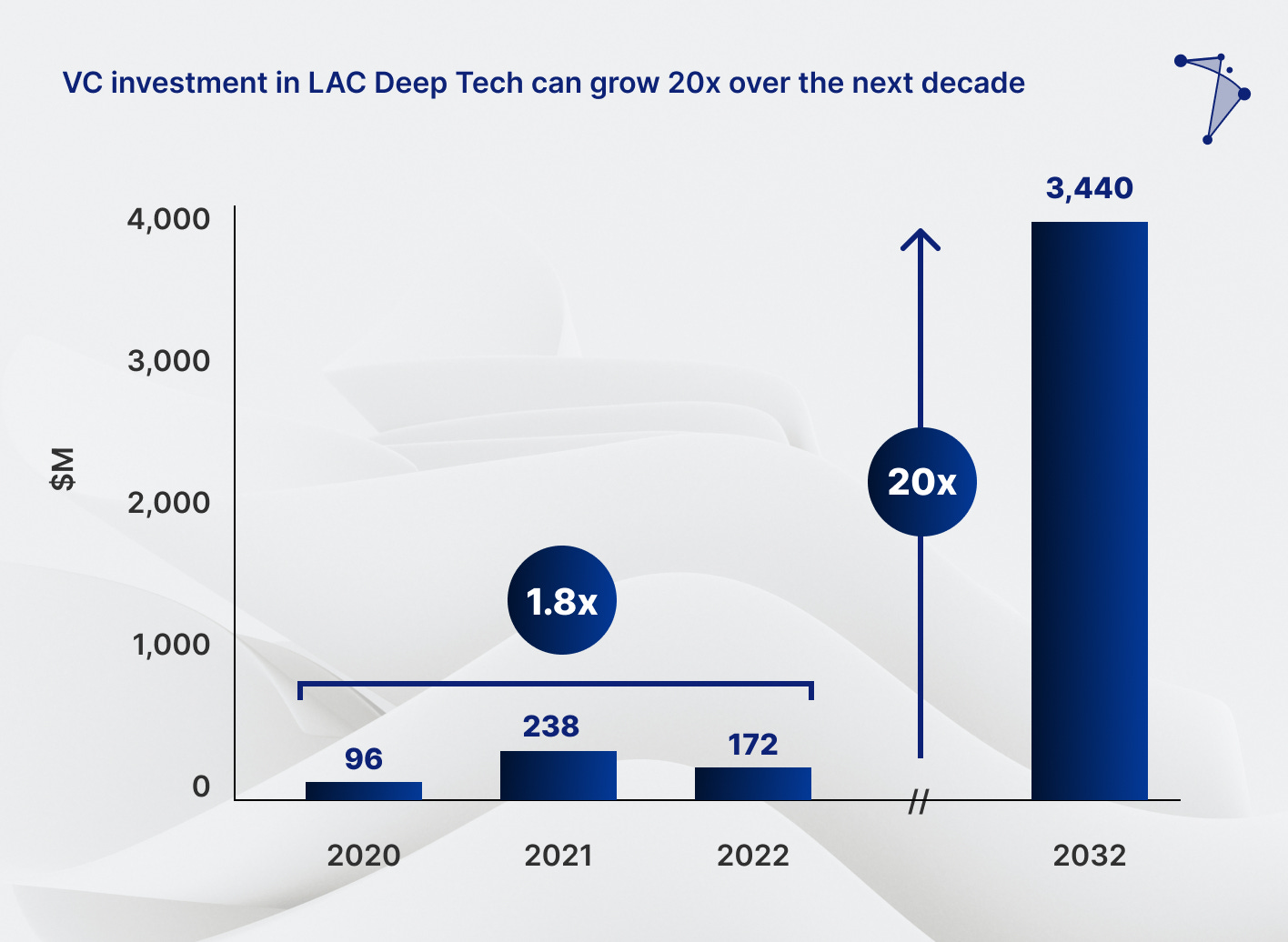

The IDB estimates a 20x expansion in the next decade, driven by a burgeoning pool of skilled researchers and engineers, the cost arbitrage for technology development, lower early-stage valuations that promise high returns, and the region’s immense biodiversity.

Furthermore, the report suggests that venture capital investment in deep tech could grow by over 100 times in the long term if it replicates proven models: matching funds for accelerators and early-stage VCs, shared labs, free zones, and participation in international agreements like the Patent Cooperation Treaty (PCT), established in 1970 by the World Intellectual Property Organization.

Looking ahead, the potential is even more promising for investors since 65% of identified startups have raised under USD 1 million, and 71% remain valued below the USD 10 million mark.

LAC also benefit greatly from its huge talent pool engaged in R&D and STEM –865k individuals, per the IDB, of which only 0.6% have joined the ranks of Deep Tech Startups—and a 5-10x cost advantage for conducting research in the region rather than in the global north.

Who Is Investing

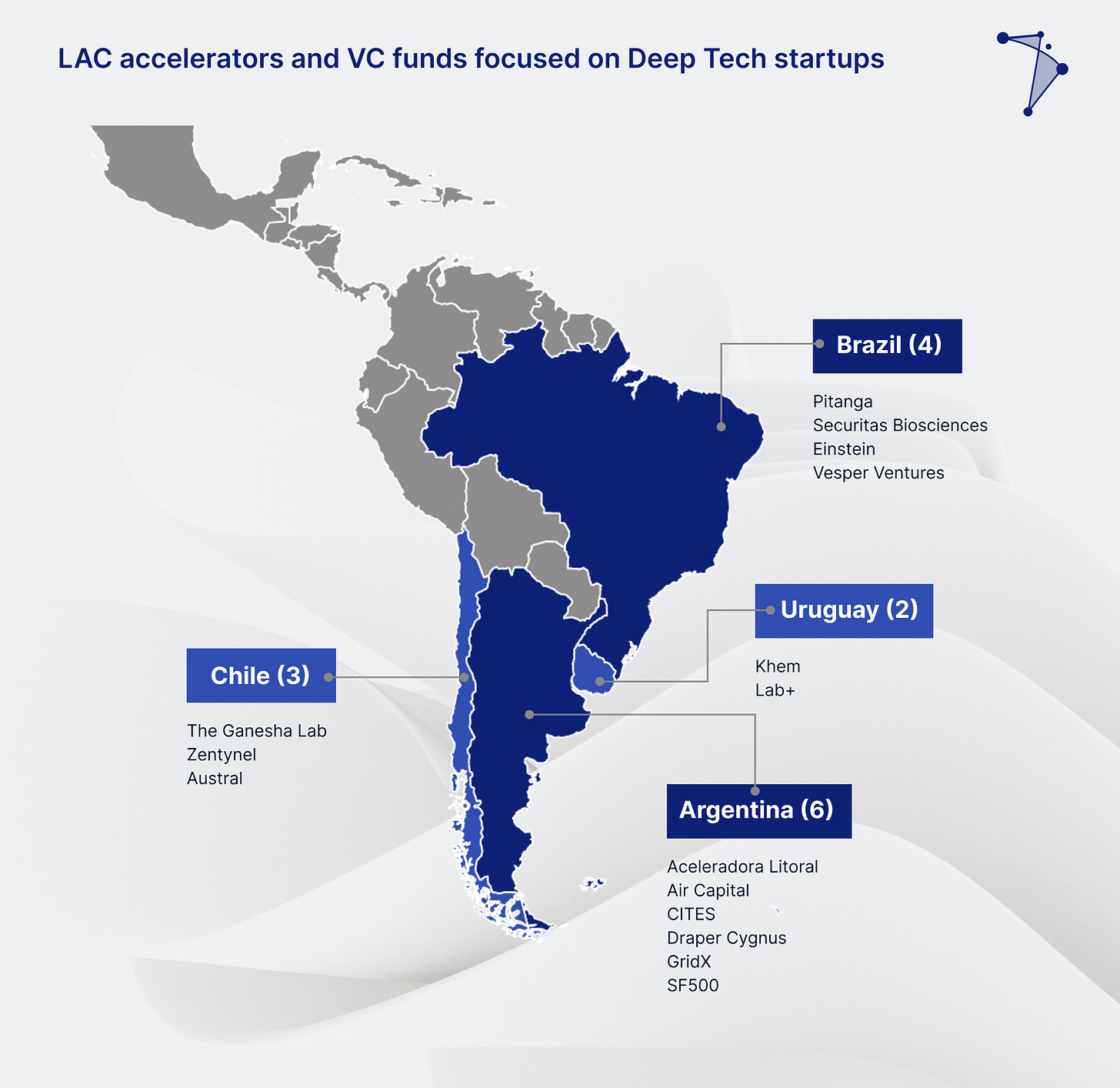

There are 65 VC funds with at least one deep tech investment in LAC, according to the IDB3. The ecosystem can be divided into three broad segments:

Regional Funds Primarily Focused on Deep Tech (15 funds).

These local investors devote more than 50% of their capital to deep tech, typically at Pre-Seed, Seed, and Series A stages. They often partner with global investors for later-stage financings.Regional Funds That Occasionally Invest in Deep Tech.

These funds focus mainly on digital startups but stay open to compelling deep tech opportunities.International Funds Investing in LAC Deep Tech.

Mostly headquartered in the United States, these firms are crucial for validation and global market access. A standout is SOSV/IndieBio, which has backed 30 regional startups, including high-profile successes like NotCo.

Regionally, two early-stage investors—GridX and The Ganesha Lab—stand out for their large volumes of deals, with 56 and 28 startups, respectively. Their active approach fosters pipelines for subsequent larger rounds. However, the lack of robust local participation in follow-on funding remains a bottleneck, highlighting the need for more seed capital and stronger LAC investor involvement in later stages.

Main Areas of Investment

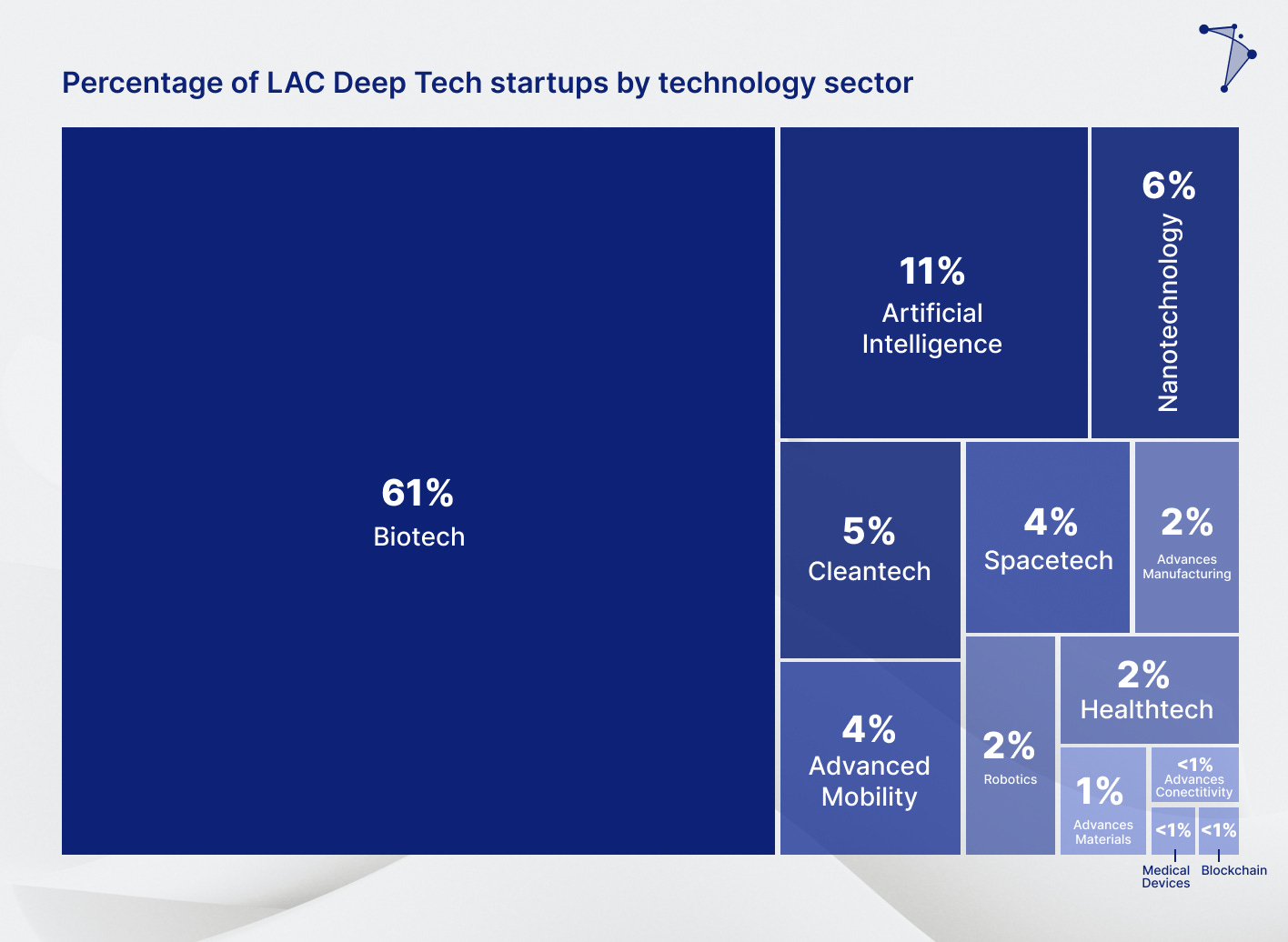

Biotechnology (61%) and Artificial Intelligence (11%) dominate LAC’s deep tech sector; together they represent 72% of regional startups. This balance reflects the critical role these technologies play in tackling challenges like sustainable agriculture, food security, and healthcare.

According to the IDB4, the prevalence of biotech aligns with the region’s “abundant specialized talent in biological sciences, the international competitiveness of the agricultural sector, and the remarkable biodiversity that serves as a resource for researchers.”

Costa Rica and Argentina illustrate this concentration, with 97% and 80% of their respective deep tech ecosystem value coming from biotech.

Establishment Labs, a Costa Rica–based biotech company, stands as the region’s most valuable player (USD 1.8 billion).

SOSV/IndieBio reported a 72% gross average return on investment in LAC deep tech startups between 2015 and 2023, underscoring the potential of this burgeoning sector.

Beyond these two leading areas, the landscape includes: Nanotechnology (6%), Clean Tech (5%), Spacetech (4%), Advanced Mobility (4%), Robotics (2%), Advanced Manufacturing (2%), Health Tech (2%), Advanced Materials (1%), Medical Devices & Others (<1%).

Challenges for Investors

Despite growing momentum, deep tech startups across LAC face complex hurdles. According to the IDB, many early-stage ventures lack strong business and communication skills, often targeting narrow markets and working with limited intellectual property protections—factors that can delay product development and create uncertainty for investors.

Francisca Covarrubias, Director of Innovation and Entrepreneurship Ecosystem Linkage at Fundación Chile, underscores these difficulties, highlighting how challenging it can be for teams to obtain the resources needed for prototyping and laboratory validation. She points out the need for “more ecosystem stakeholders specialized in technology with a business vision,” as well as a stronger link between scientists and industry partners5.

The Sciencepreneurs: Deep Tech Colombia 2023 report adds that the multidisciplinary nature of many deep tech initiatives brings its own obstacles. Founders must navigate technology transfer, patent regulations, and effective networking among various scientific and business fields—hurdles that explain why so many companies struggle to raise even USD 1 million in institutional funding6.

About LADP

At LADP, we are working to identify, participate in, and foster Deep Tech networks of startups and builders across LAC. Our mission is to address challenges related to institutional frameworks, education systems, infrastructure limitations, and market environment paradigms that currently hinder large-scale by systematically adopting and implementing international best practices in ecosystem

https://publications.iadb.org/es/publications/english/viewer/Deep-Tech-The-New-Wave.pdf

https://sciencebusiness.net/news/europe-overtakes-asia-deep-tech-investment

https://publications.iadb.org/es/publications/english/viewer/Deep-Tech-The-New-Wave.pdf

https://publications.iadb.org/es/publications/english/viewer/Deep-Tech-The-New-Wave.pdf

https://www.latercera.com/que-pasa/noticia/columna-de-opinion-de-francisca-contreras-deep-tech-startups-made-in-chile/BMFXAZQBXVFOJBIEDQAX74SMWI/

https://www.olartemoure.com/wp-content/uploads/2024/04/Informe-Deeptech-Colombia.pdf