Investors Roundtable: A Stronger Regional Coalition with Global Reach

Insights from LADP's Second Convening

LADP recently hosted a roundtable with regional and global investors, as well as key voices from civil society, to discuss the critical challenges facing Latin America’s deep tech investors ecosystem.

Specifically, we asked them what do deep tech investors in LATAM need to secure both global and regional investment.

Drawing from our literature review, we set the stage by introducing the premise: “Funding focuses mainly on pre-seed and seed stages”, as venture capital funding in Latin America’s Deep Tech sector is overwhelmingly concentrated at the earliest stages.

Scalability beyond pre-seed funding

According to the 2023 Deep Tech: The New Report, an impressive 65% of Deep Tech startups in LATAM are still in their pre-seed and seed phases, having raised less than $1 million. In stark contrast, a scant 6% of these startups have progressed to secure investments exceeding $10 million1.

“These figures highlight the nascent state of the ecosystem and underscore the immense growth potential that venture capital activity holds within this dynamic landscape”, the authors of the report stated.

Furthermore, in 2023 Latin America saw a total of $162 million invested in deep tech, with $130 million allocated to Series B and C rounds. However, the dynamics shifted notably in 2024, when the registered investment in deep tech totaled $138 million in LatAm, yet not a single Series B or C round was recorded2.

This bottleneck has been consistently mentioned throughout our interviews. To understand this reluctance from investors, we opened the discussion by posing the question: What key gaps make LATAM investment less attractive to global VCs, and which resources or support systems would help bridge that gap?

LATAM Discount

The "LATAM Discount" refers to the phenomenon where startups and companies in Latin America are often valued lower than their counterparts in other regions, such as the United States, Europe or other emerging markets, despite having similar or even superior metrics. This discount is attributed to perceived risks, including political instability, economic volatility, and regulatory challenges, which can deter investors.

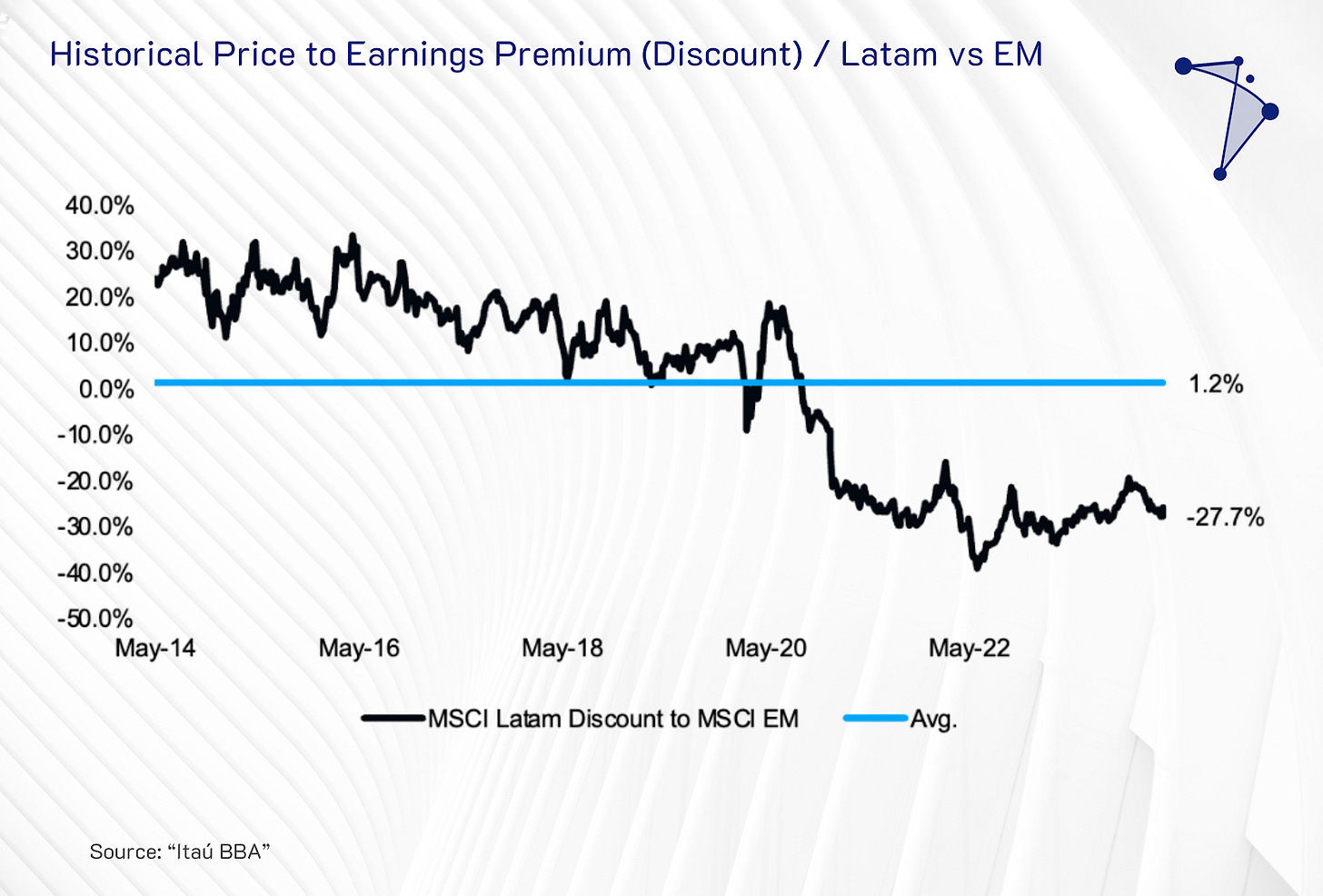

Even in traditional equities markets, Latin American equities have traded at a significant discount to global averages and Emerging Markets (EM) in the last years. The MSCI LATAM Index, which captures large and mid cap representation in Brazil, Chile, Colombia, Mexico, and Peru, suggests LATAM is trading at -51% Discount compared to the world, above the historical average of -13.9%.

According to Itaú BBA analysis, “this can be partially explained by the rising relevance of tech companies in global indexes, at a higher pace than EMs, while LATAM has virtually small exposure to this sector”.

When comparing the region to the Emerging Markets, LATAM countries are Trading at a higher discount as well, a -27.7% Discount as of 2024.3

When looking at the factors that drive the risks and returns, thus the “LATAM Discount”, the MSCI Emerging Markets Latin America Index, published in 2025, compares the factor exposures of LATAM and other Emerging Markets (EM) like China or India, against a global benchmark (MSCI ACWI IMI)4.

The 6 main factors are Value, Low Size, Momentum, Quality, Yield and Low Volatility. The horizontal axis shows each factor’s relative tilt, with zero representing the global benchmark. A positive value means the index is overexposed to that factor compared to the global average, while a negative value indicates underexposure.

From the 6 main factors identified, LATAM is especially overexposed to Volatility, represented by commodity exposure, macroeconomic swings and political risks, amongst others. This is typically negative, and can deter global equities investors in the short and long term.

In parallel, LATAM lags behind other emerging markets and the global benchmark, which indicates fewer high-quality balance sheets or fewer stocks with strong price momentum compared to the global average.

Finally, it’s also worth noting the exposure to the Low Size factors. A negative Low Size tilt suggests the index is more concentrated in large-cap stocks. Being negative means both LatAm and other EM indexes lean towards bigger companies compared to the global benchmark.

In the startup context, the LATAM Discount is often discussed in terms of venture capital and private equity investments. Investors may apply a discount to valuations due to concerns about market size, currency risk, and the maturity of the entrepreneurial ecosystem.

The regional investors participating in our roundtable discussion emphasized the recurring issue of the LATAM Discount, a matter of considerable frustration as they believe their portfolios demonstrate sufficient strength for competition on a global scale.

Skepticism towards LATAM’s R&D

Among the chief pain points identified were skepticism toward LATAM’s R&D capabilities and a fragmented regulatory landscape; meanwhile, the main recommendations to advance included promoting cross-border regulatory innovation, and building a stronger regional coalition with global reach

Deep tech companies rely extensively on R&D at top-tier academic institutions. In fact, their defining characteristic is that they emerge after years of rigorous research and experimentation carried out by individual scientists or teams of PhDs, in many cases.

This process involves the development of robust intellectual property and a lengthy, strategic technology transfer from academia to the commercial sector, setting the foundation for groundbreaking, commercial innovation.

This process is long, though. The entire journey—from research and prototyping, through development, validation, and finally commercialization—takes 25-40% longer to translate into returns for investors if compared to the time-horizon of a conventional software company, according to estimates by the Boston Consulting Group5.

However, before even thinking about commercialization, the primary risk at these early stages is the robustness of the underlying science of deep tech ventures. It is at this very early stage that some regional investors raised a flag:

Many times, Latin American deep tech ventures often face skepticism from international investors regarding the robustness and credibility of their early-stage scientific research, doubting whether the underlying science is sound enough to support scalable, global business models.

While this issue is difficult to quantify, it is far from new. In 2024, Garret Dempsey—a global investor active in deep tech across both the U.S. and LATAM—highlighted the challenge: “U.S. investors, accustomed to evaluating founders and technologies emerging from prestigious institutions like Stanford, MIT, and Harvard, might doubt the credibility of innovations presented by founders from lesser-known universities in LatAm. This skepticism forces founders to undertake the additional challenge of proving the reliability of their technology and data.”

Consequently, this skepticism often results in an extended deliberation process for international investors—sometimes even perceived as biased—at a crucial stage in the development of deep tech companies.

A Fragmented Regulatory Landscape

In LATAM, there is no centralized regulatory agency that oversees the trial phases and market readiness of, say, emerging biotech or agtech innovations looking to come to market.

Each country enforces its own distinct set of rules, and they can differ dramatically from one country to the next, making it exceedingly difficult to expand operations within LATAM, and treat the region as a unified market.

For international investors, this augments the risk of investing, as it may not be strategic to back an early-stage startup that only complies with regulations of a single country, thus impeding their regional and global expansion.

There was broad agreement upon this challenge throughout the roundtable. To bypass this hurdle, regional investors stated that they have been encouraging the startups in their portfolio to work with a global-first approach from the beginning, like the US’s Food and Drug Administration regulations, to immediately meet international standards for trial phases.

By aligning their products and processes with FDA regulatory frameworks, companies can signal adherence to rigorous, internationally recognized standards. This could make deep tech ventures considerably more attractive to global investors by reducing perceived risks and facilitating smoother market entry.

Furthermore, participants suggested devising a public-private initiative that coordinates with regulatory agencies across different countries to fast track their application processes. Could a unified LATAM-framework—aligned with international standards—serve as a catalyst for accelerating deep tech innovation? Could such a framework, if implemented in key markets like Brazil or Mexico, enhance the region’s credibility and make its innovations more favorably regarded on the global stage?

Innovative Regulatory Frameworks

Although countries such as Chile, Colombia, Mexico, and Argentina have been advancing legislative initiatives and supporting technology transfer between universities and the industrial sector for at least 10 years, some attendees believe that such instances alone will not be enough.

Below, we highlight some of the innovative regulatory strategies that several governments in the region are implementing to accelerate the development and scaling of deep tech innovations in LATAM.

México (2015)

Mexico approved a series of reforms to the Law of Science and Technology and the Federal Law of Administrative Responsibilities of Public Servants. These reforms aimed to except public researchers from the conflict of interest that arose when participating in the creation of a company.

Brazil (2016)

Brazil enacted Innovation Law 13.423/16, which led to the creation of Technological Innovation Nuclei (NIT) to foster connections between companies and scientific institutions. This law also made paid transfer activities compatible with the career of full-time researchers and allowed researchers to request licenses for up to six years to dedicate themselves to creating a company

Colombia (2017)

Colombian Congress enacted the Spin-off Law (1838/2017). This law aims to allow researchers from public universities to create companies based on their scientific developments. It clarifies the legal ambiguity regarding the dual remuneration of academics who receive a public salary and additional benefits from the profits of these companies

Argentina (2019)

As of 2013, CONICET (National Scientific and Technical Research Council) had regulations that limited the possibilities for researchers to participate in company creation based on their research results. In 2019, CONICET established a new regulation that includes the possibility of obtaining a two-year license for researchers to participate in the creation of an ECT.

Chile (2020, 2024)

On top of the governmental subsidies to undergraduate and graduate students who want to create a company based on their thesis, since 2020 the Congress is working on a bill to promote research in higher education institutions and to increase the flexibility of their technology and knowledge transfer structures, to facilitate the creation of science-based technology companies within universities.

In 2024, a bill was introduced to develop a network of hubs for deep tech startups in Chile, consisting of shared labs, incubators and accelerators6.

While these measures are certainly positive, participants agreed that they are not enough and that additional alternatives should be explored. Some participants also shared their interest in leveraging Special Economic Zones as catalysts for the development of deep tech in the region.

Special Economic Zones, Free Trade Zones & more

Special Economic Zones (SEZs), also referred to as Free Zones, depending on the jurisdiction, have been long looked up to as models to attract and develop hardware operations necessary for deep tech’s R&D, and also to boost the hosting nation with FDI and jobs.

SEZs are demarcated areas within a country's borders that have distinct business regulations compared to the rest of the country. These differences primarily relate to investment conditions, international trade, customs, taxes, and regulations. SEZ activities encompass a wide range of sectors, including manufacturing, agriculture, tourism, trade, and real estate development.

There are over 5,000 SEZs globally, with 630 located in LATAM. Some examples include the special economic zone in Yucatán, Mexico7, as well as the Colón Free Trade Zone and Panamá Pacífico Special Economic Zone in Panamá8, and Honduras' Próspera. Open Zone Map is a comprehensive resource that charts special economic zones globally.

Although results vary by region, these are some of the benefits of SEZ, both for hosting countries and the companies operating within them:

Generation of direct and indirect jobs for the hosting country: in the Dominican Republic, for example, SEZs provided about 166,000 direct jobs and an estimated 250,000 indirect ones in 20179.

Preferential access to international markets: in LATAM, SEZs have been used to access U.S. markets, generating large-scale manufacturing sectors in economies previously reliant on agricultural commodities.

Hardware providers for deep tech companies: SEZs can provide infrastructure facilities for R&D purposes, a critical step in deep tech companies10. In parallel, this can significantly advance technology transfer for hosting countries, by shifting the skills levels from production to design and R&D, as documented in the Philippines as far as 200811.

On the downside, others have argued that they SEZ can undermine national sovereignty and endanger local communities:

Threat to Sovereignty and Local Communities: Critics argue that SEZs like Próspera in Honduras undermine national sovereignty by allowing foreign investors to operate under separate legal and regulatory frameworks12, leading to a increasing perception of neocolonialism13.

Land Acquisition and Displacement: SEZs often require large tracts of land, leading to the displacement of local communities and loss of livelihoods, particularly for farmers and indigenous groups.

A Stronger Regional Coalition, with Global Reach

In the second half of our roundtable discussion, our focus shifted toward envisioning a regional coalition capable of bridging local startups with global investment opportunities. The consensus was unequivocal: there is a significant lack of visibility regarding both the progress achieved to date and the future potential. This opacity has fostered a widespread perception among international investors that LATAM deep tech companies struggle to scale through funding stages, secure exits, and generate strong returns.

Building on these insights, participants expressed strong agreement with LADP’s thesis: the only way to bridge the gap between regional and international markets is to establish a coalition of stakeholders that efficiently coordinates efforts across borders, aligning incentives among entrepreneurs, corporates, government, and risk capital.

Concretely, the coalition should focus on:

Showcasing Success Stories: Highlight deep tech companies with a proven track record of investment returns, thereby shifting the narrative from the challenges faced by LATAM’s deep tech ecosystem to its promising upsides.

Strengthening Academic Partnerships: Forge deeper relationships with top-tier universities and research institutions across the region, in the US, and Europe to provide more robust academic rigour to the scientific innovations.

Integrating International Expertise: Involve international experts within local ecosystems to meet global due diligence standards and boost investor confidence.

Expanding Investor Networks: Develop robust relationships with international investors beyond personal contacts.

Facilitating Knowledge Exchange: Promote joint research initiatives, and organize conferences and meetups across the region to foster collaboration and innovation.

Now is the time to turn these insights into action. Reach out or directly book a meeting if you are interested in building this coalition, and subscribe to our newsletter for regular updates!

About LADP

At LADP, we are working to identify, participate in, and foster Deep Tech networks of startups and builders across LATAM. Our mission is to address challenges related to institutional frameworks, education systems, infrastructure limitations, and market environment paradigms that currently hinder large-scale development by systematically adopting and implementing international best practices in the ecosystem.

https://publications.iadb.org/es/publications/english/viewer/Deep-Tech-The-New-Wave.pdf

https://app.dealroom.co/sector/technology/Deep%20Tech/investors/?hqType=regions&hqValue=Latin+America&sourceOfFundsInvestorLocation=investor-location&sourceOfFundsInvestorType=rounds

https://mindassets.cloud.itau.com.br/attachments/facd8655-6db0-4dfb-a25b-1e3d2fd76050/EQUITY_STRATEGY_THEMATIC_BOOK_20240513.pdf

https://www.msci.com/documents/10199/5b537e9c-ab98-49e4-88b5-bf0aed926b9b

https://web-assets.bcg.com/a8/e4/d3f2698b436aa0f23aed168cd2ef/bcg-an-investors-guide-to-deep-tech-nov-2023-1.pdf

https://www.corfo.cl/sites/cpp/sala_de_prensa/nacional/22_11_2024_startup_labs;jsessionid=OeVVF8fGZngrtAcSqvOb-zg2J4rax4o75elBla0_ya-Oy3hojknT!678775723!296284750

https://investmentpolicy.unctad.org/investment-policy-monitor/measures/4783/mexico-adopts-new-tax-incentives-for-special-economic-zones-in-yucatan

https://www.trade.gov/market-intelligence/panama-special-economic-zones

https://unctad.org/system/files/official-document/wir2020_en.pdf

https://publications.iadb.org/es/publications/english/viewer/Deep-Tech-The-New-Wave.pdf

https://documents.worldbank.org/en/publication/documents-reports/documentdetail/343901468330977533/special-economic-zone-performance-lessons-learned-and-implication-for-zone-development

https://foreignpolicy.com/2024/01/24/honduras-zedes-us-prospera-world-bank-biden-castro/

https://jacobin.com/2023/11/honduras-international-law-isds-thiel-prospera-free-market-neocolonialism