LATAM’s AI Ecosystem: Driving Innovation Amid Readiness Complexities

Artificial Intelligence (AI) has become a cornerstone of innovation across industries. The International Data Corporation estimates AI will contribute $19.9 billion to the global economy by 2030, representing 3.5% of the world’s GDP1.

Regionally, Latin America and the Caribbean (LATAM) is keeping pace with this booming trend. Approximately 47% of Latin American companies have actively integrated artificial intelligence into their business operations, surpassing the global adoption rate by five percentage points. In contrast, only 16% of companies in the region report having no interest in exploring AI as part of their digital transformation efforts2.

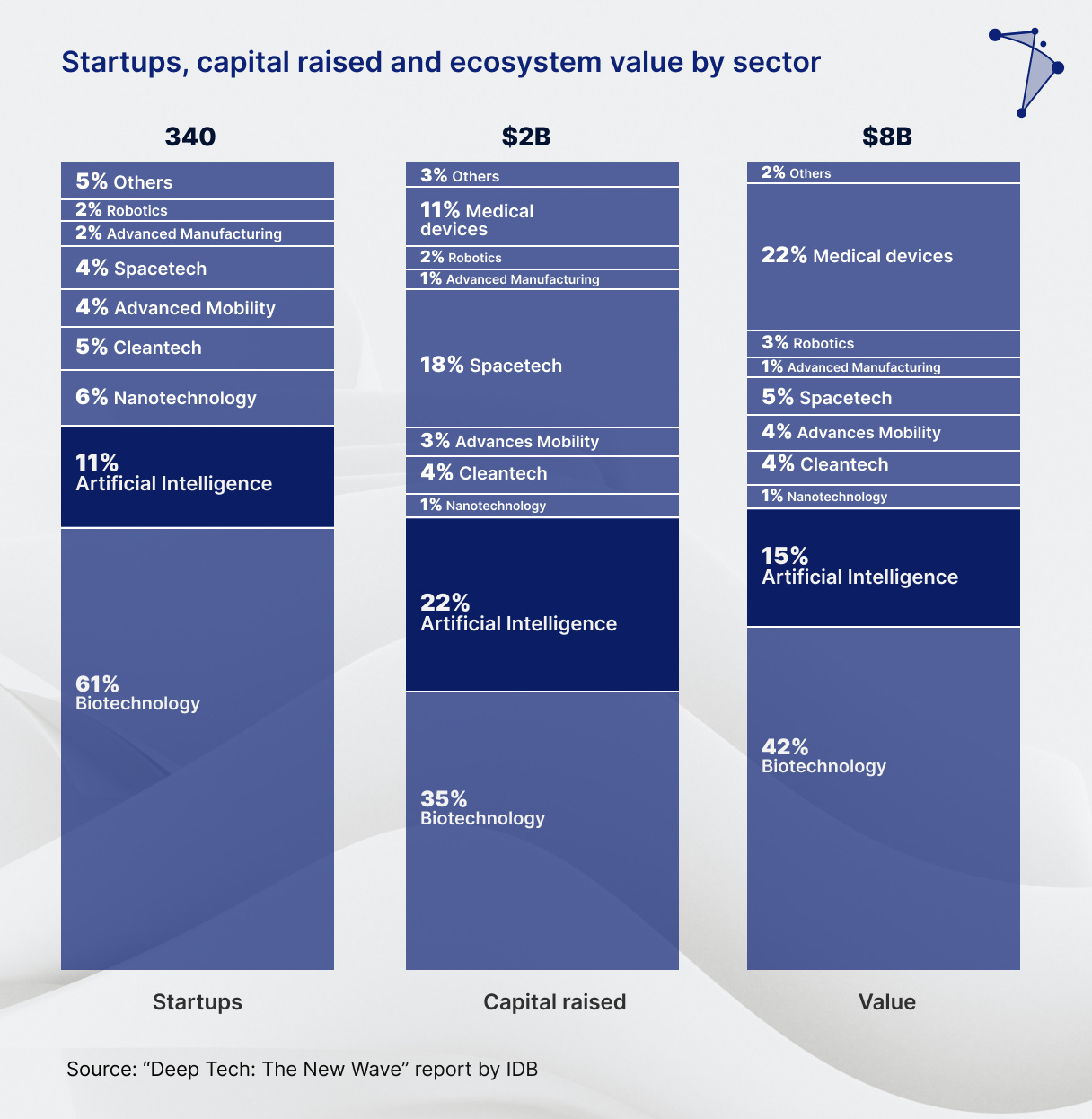

Moreover, AI's influence in LATAM extends beyond corporate adoption. Startups and companies are developing innovative AI tools for both regional and global applications. According to the Inter-American Development Bank (IDB) report Deep Tech: The New Wave, 11% of LATAM Deep Tech companies that have raised over $1 million from institutional investors are AI-focused—making AI the second-largest Deep Tech vertical in the region after biotech (61%)3.

From well-established companies founded in LATAM like NotCo, which uses AI to create plant-based alternatives to animal products (valued at 1.5 billion dollars4), to Runway, a generative AI platform for audiovisual content (also valued at 1.5 billion dollars5), AI is already at the forefront of LATAM’s Deep Tech landscape.

In this blog, we will explore the inherent complexities of AI readiness in LATAM, the challenges and opportunities for investors, and profile the top countries and companies that stand out in the sector.

LATAM’s AI Momentum

LATAM is uniquely positioned to embrace AI adoption due to its dynamic and evolving digital ecosystems.

According to the IDB, the region can enhance government efficiency, create smarter cities, and address critical gaps in education and healthcare by adopting AI. Fostering inclusive ecosystems that prioritize ethical considerations, skill development, and equitable access to technology will position AI not just as a tool for innovation but as a catalyst for long-term sustainable growth in the region.

Building on its adoption and investment readiness, AI is already a standout within the region’s Deep Tech ecosystem. It is the second-largest Deep Tech sector in the region and contributes 15% of the 8 billion USD created-value within LATAM—third only to biotech (42%) and medical devices (22%).

In terms of capital, AI startups raised 22% of the 2 billion USD invested by VC’s in LATAM from 2018 to 2023, second only to biotech (35%).

Complexities behind LATAM’s AI Momentum

The 2024 “Latin American Artificial Intelligence Index” (ILIA)6 presents a comprehensive benchmark to understand key drivers, readiness, and underlying challenges of AI adoption in the region. Now in its second edition, ILIA distilled its insights into 10 essential findings that describe the region's complexities.

Talent Gap: The concentration of AI talent in Latin America has doubled in the past eight years, yet no country matches Global North levels, maintaining a significant gap.

AI Literacy: The skills gap in AI engineering is five times wider compared to industrialized nations. However, AI literacy penetration is higher in some countries, presenting opportunities to improve workforce skills.

Brain Drain: Since 2019, Latin America has consistently lost more AI specialists than it has attracted, except for isolated cases in Costa Rica and Uruguay.

Economic Boost: In Chile alone, generative AI could enhance the productivity of 5.69 million workers in the country’s top 100 occupations, potentially raising the national GDP by 1.2 percentage points.

Economic Matrix Impact: Liberal economies like Chile, Uruguay, and Costa Rica lead in entrepreneurship and private investment, while industrial powers like Mexico and Brazil excel in patents, high-tech workforce, unicorn startups, and cutting-edge manufacturing.

Gender Gaps: Women’s participation in AI varies widely, with some countries showing robust figures but overall reflecting insufficient efforts to close the gender gap.

Multidisciplinary Growth: Approximately 80% of AI-related publications in the region are multidisciplinary, with 70% concentrated in 10 key disciplines, particularly clinical medicine.

Legislative Momentum: The region has 38 AI-related legal initiatives, addressing topics like modifying penal codes for generative AI misuse, including fraud (Chile) and privacy violations (Mexico).

Lack of Urgency: Despite progress, most national AI policies lack substantial resources and urgency to close gaps and capitalize on AI’s potential.

Startup Challenges: AI startups remain concentrated in a few countries, with limited private investment and a scarcity of unicorns, highlighting the need for stronger funding and support systems.

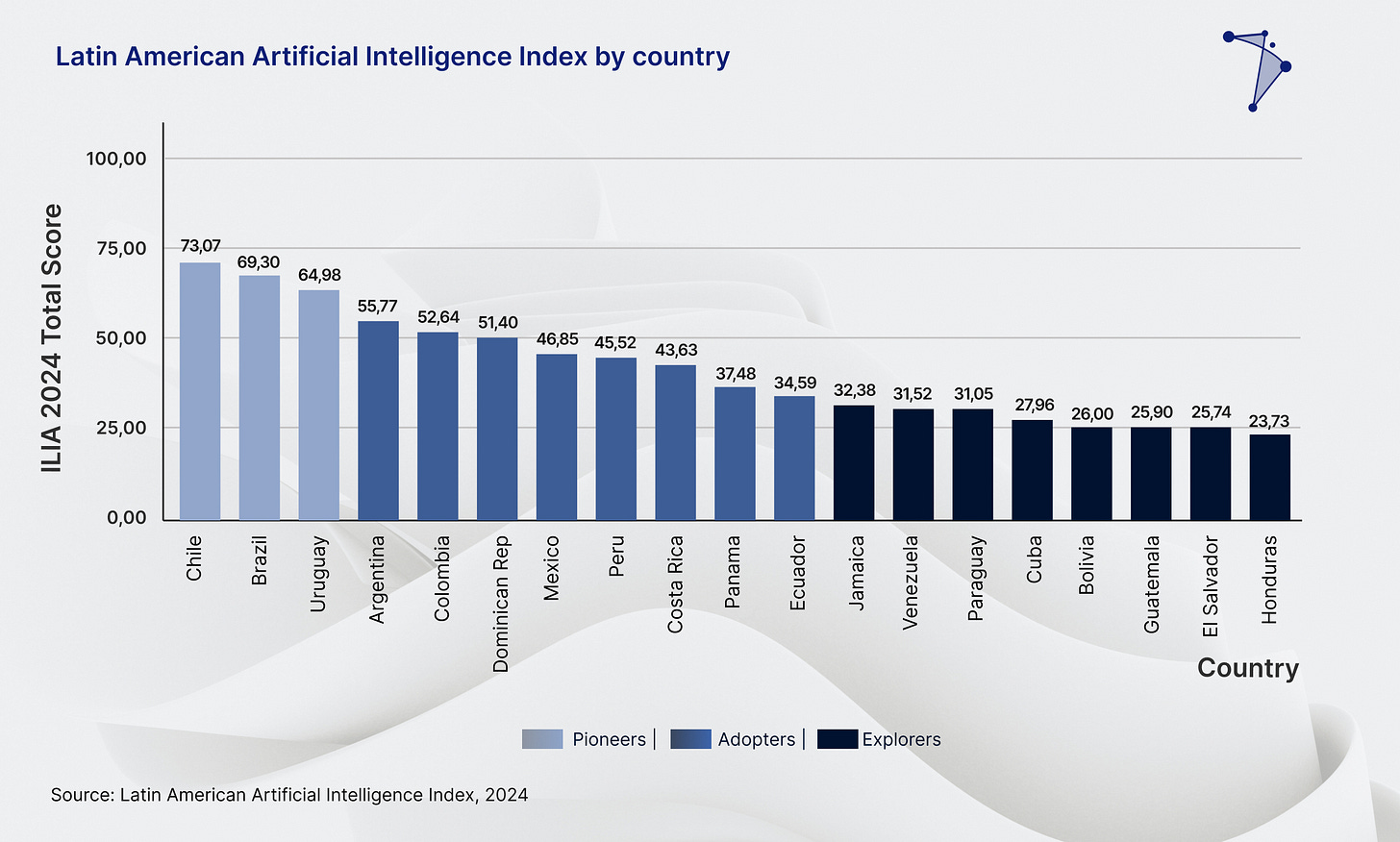

Factoring all these dimensions, ILIA featured individual scores for each of the 19 LATAM countries to rank their AI ecosystem maturity levels.

Chile, Brazil, and Uruguay are the Pioneers of the region, distinguished by their advanced technological infrastructure, robust talent development, scientific productivity, and strong innovation capacity. These nations are also proactively shaping national strategies to consolidate and expand technological advancements across all sectors of their economies and societies.

Argentina, Colombia, the Dominican Republic, and Mexico are the leading Adopters, representing countries that have begun integrating AI into various sectors of their economies and societies but have yet to establish a position of leadership.

Honduras, El Salvador, Guatemala, and Bolivia are classified as Explorers, falling behind in the adoption curve. These countries are in the initial stages of investigating AI, focusing on developing basic capacities but with limited AI-based applications and a nascent research community.

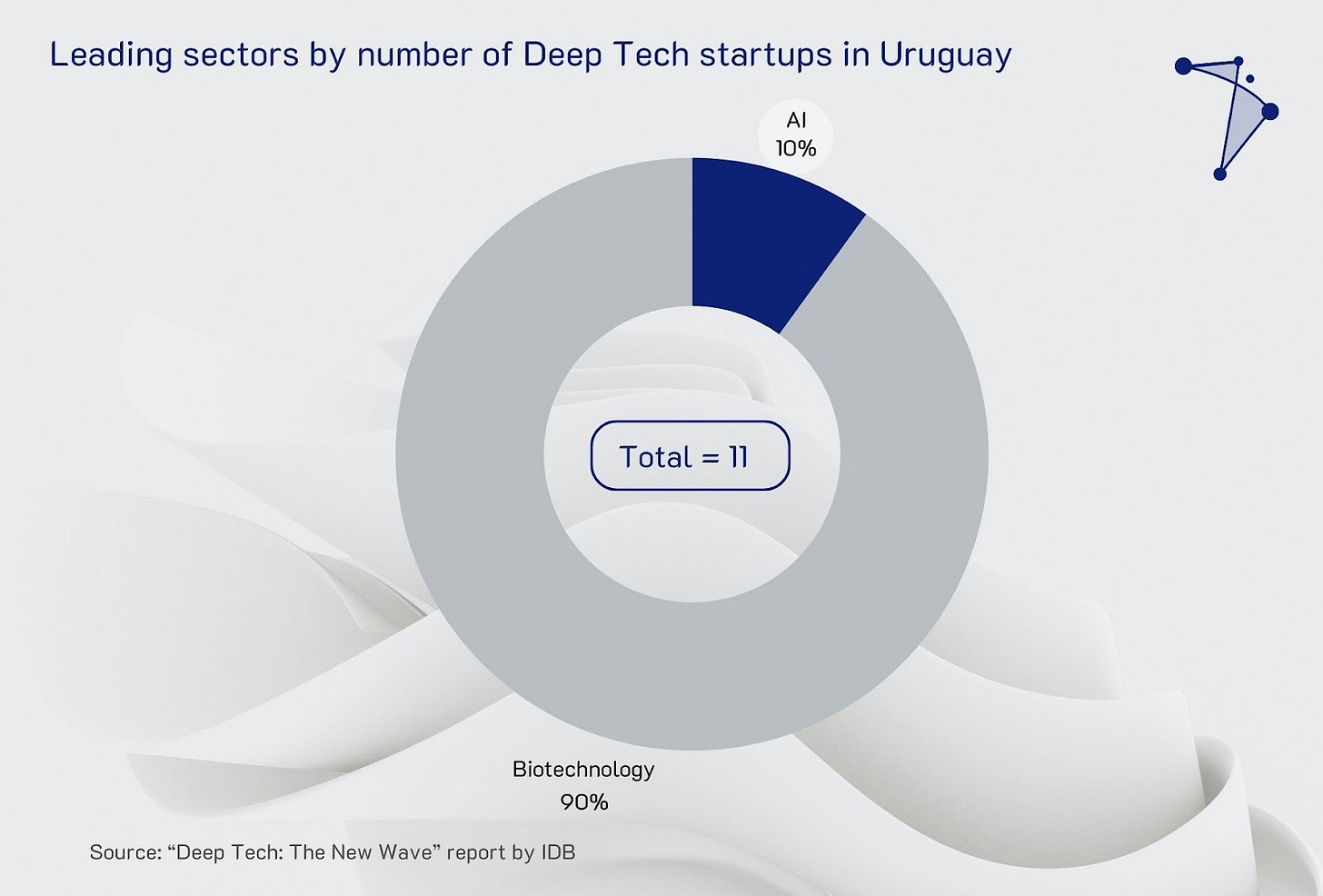

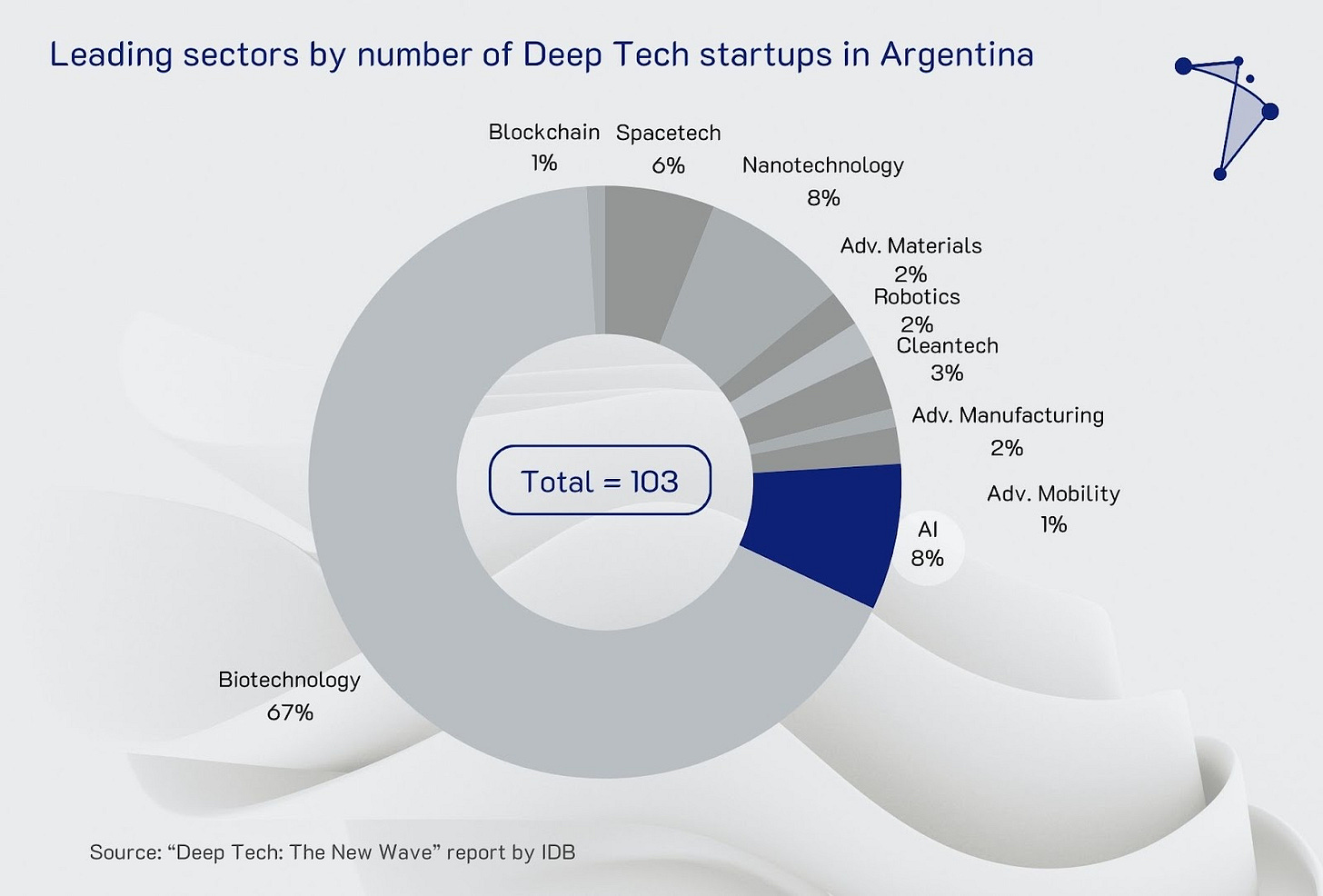

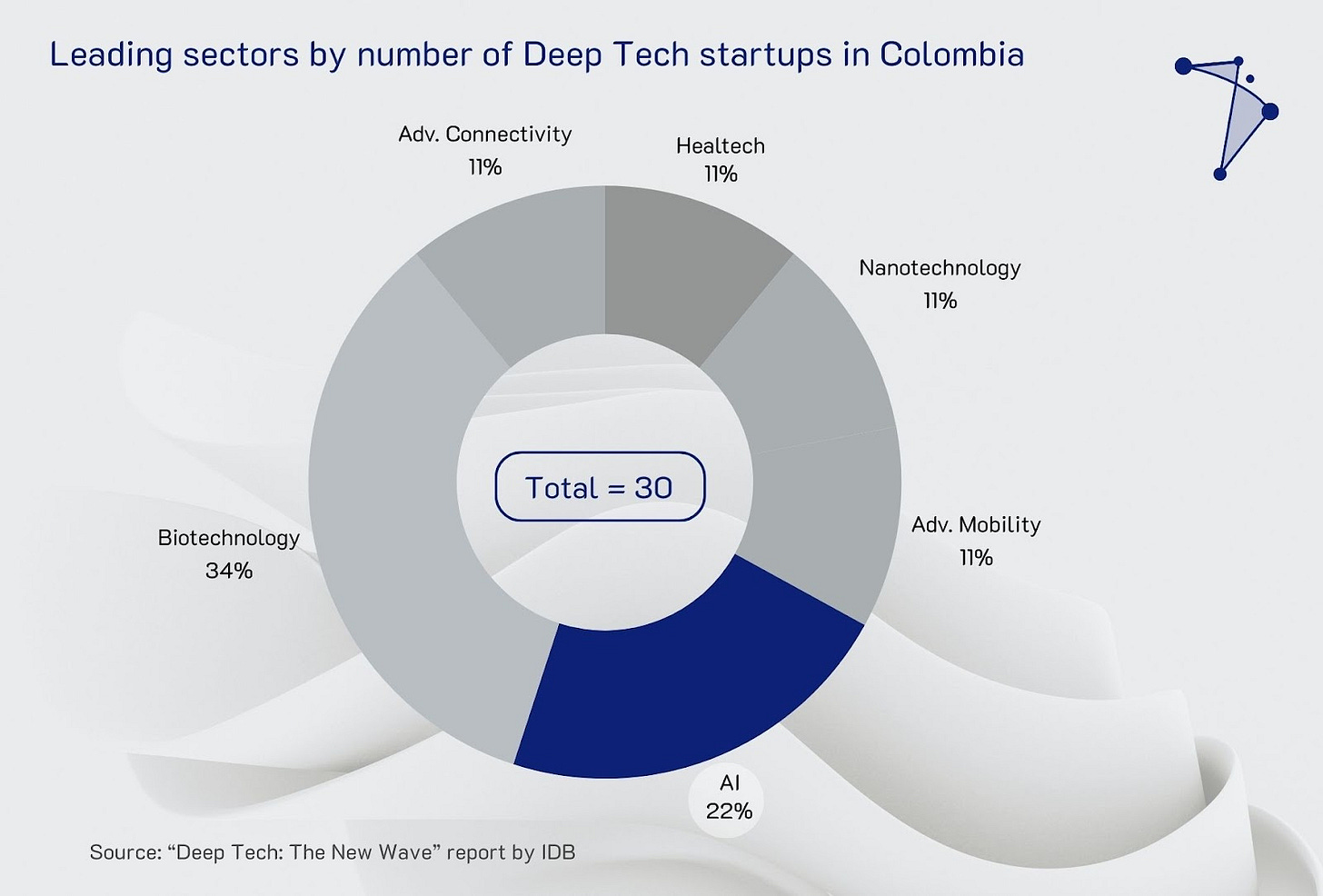

Leading sectors by number of Deep Tech startups, per the IDB

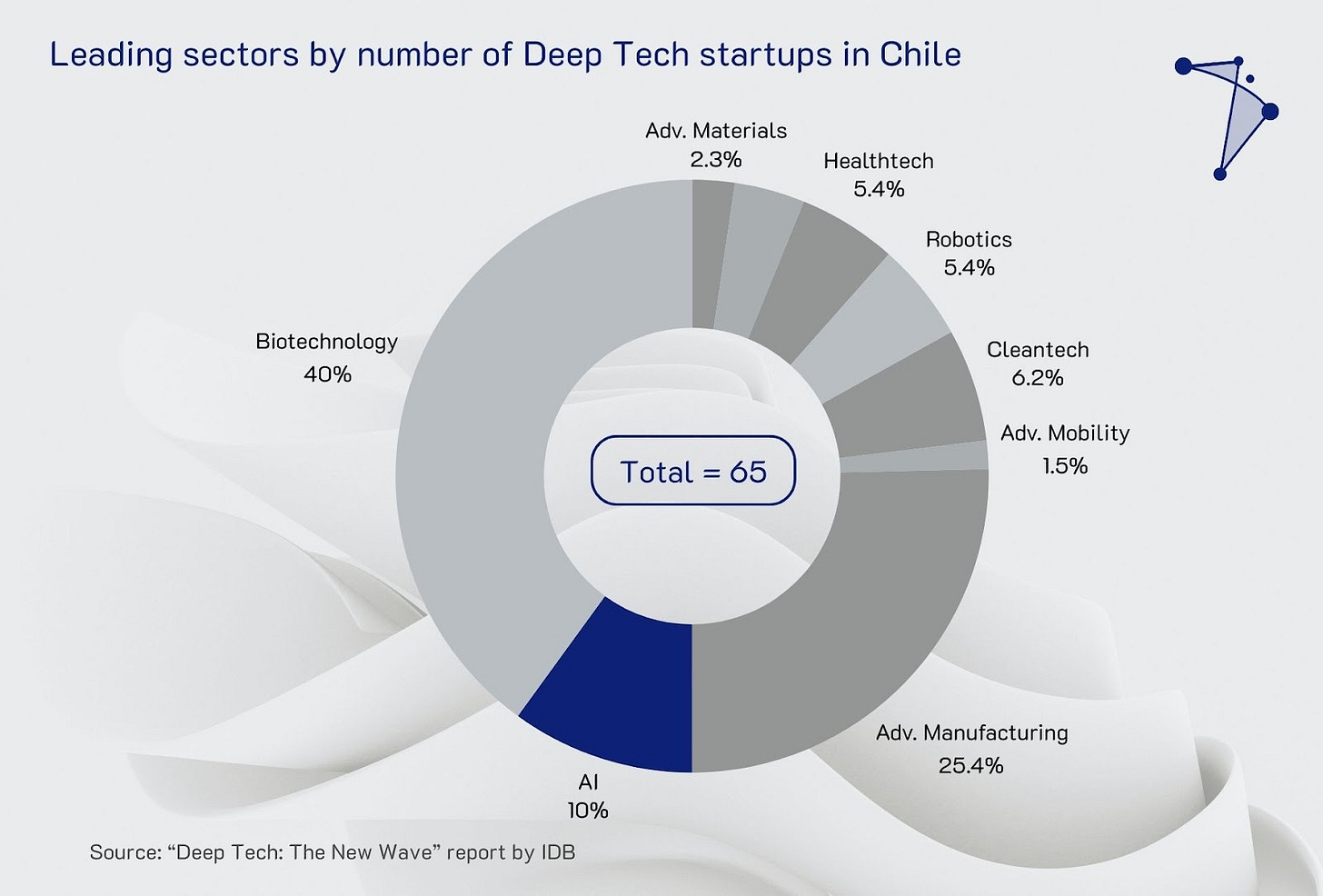

Chile (1st on ILIA’s Index)

Of the 65 Deep Tech startups that have received VC funding, 13% focus on AI, the second largest group after biotech (52%) .

While biotech startups dominate in terms of number, accounting for over 50% of the total Deep Tech startups, AI leads in terms of value, largely due to NotCo’s rapid growth, a company worth 1.5 billion USD.

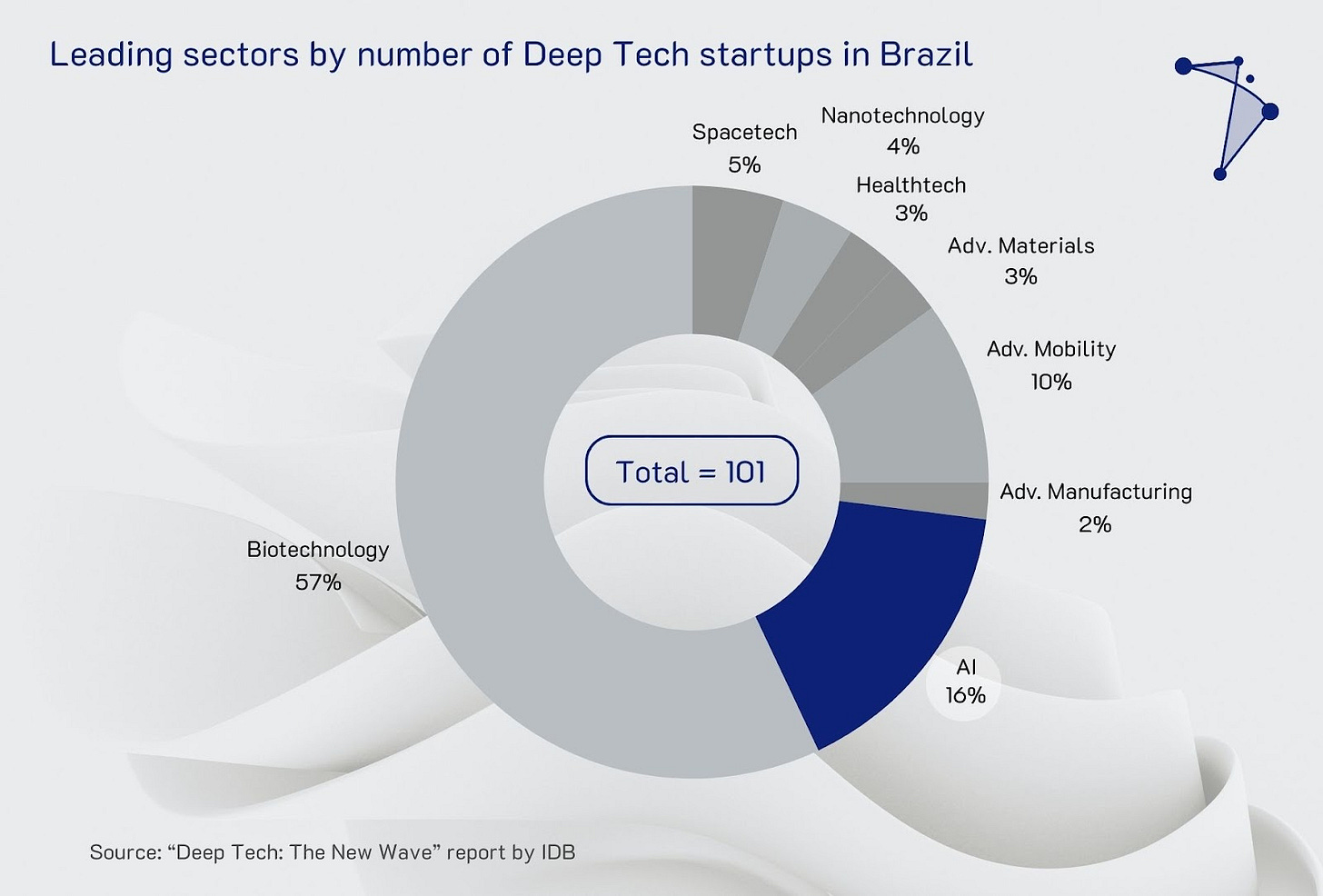

Brazil (2nd on ILIA’s Index)

Of the 101 Deep Tech startups that have received VC funding, 16% focus on AI, the second largest group after biotech (57%).

There’s no AI company highlighted in the Top Deep Tech Startups report by the IDB.

Uruguay (3rd on ILIA’s Index)

Of the 11 Deep Tech startups that have received VC funding, 10% focus on AI, the second largest group after biotech (90%) .

MetaBIX Bio, a company leveraging AI and biotechnology to predict and prevent diseases affecting plants, animals, and humans, is worth 1.5 million USD.

Argentina (4th on ILIA’s Index)

Of the 103 Deep Tech startups that have received VC funding, 8% focus on AI, the second biggest one after biotech (67%), and co-equal with nanotechnology.

There’s no AI company highlighted in the Top Deep Tech Startups report by the IDB

Colombia (5th on ILIA’s Index)

Of the 30 Deep Tech startups that have received VC funding, 22% focus on AI, the second largest group after biotech (33%) .

Colombia is the country with the biggest percentage of AI startups in the region.

There’s no AI company highlighted in the Top Deep Tech Startups report by the IDB

Conclusions

While LATAM faces hurdles such as talent gaps, brain drain, and limited investment resources, these challenges also represent opportunities. Addressing these gaps through inclusive education, skill development, and improved policy frameworks can position the region for long-term growth in AI.

Countries like Chile, Brazil, and Uruguay, as highlighted in the ILIA Index, are paving the way through collaborative efforts between governments, startups, investors, and educational institutions. These examples underline the importance of partnership-driven strategies to build a sustainable and impactful AI ecosystem in the region. By expanding these models and fostering cooperation across the region, LATAM can secure its place as a global leader in AI innovation.

From an investor and stakeholder perspective, it’s worth noting the diverse strengths shown by countries across the region. Chile’s AI startups dominate in value (e.g., NotCo), Brazil leads in the number of AI startups (16), and Colombia has the highest percentage of AI-focused startups (22%). This diversity offers investors and stakeholders a rich AI landscape to engage with.

About LADP

At LADP, we are working to identify, participate in, and foster Deep Tech networks of startups and builders across LATAM. Our mission is to address challenges related to institutional frameworks, education systems, infrastructure limitations, and market environment paradigms that currently hinder large-scale development by systematically adopting and implementing international best practices in the ecosystem.

https://www.idc.com/getdoc.jsp?containerId=prEUR152702124

https://es.statista.com/estadisticas/1394415/ia-tasa-de-adopcion-e-implementacion-empresarial-mundial-y-comparacion-con-latinoamerica/

https://publications.iadb.org/es/publications/english/viewer/Deep-Tech-The-New-Wave.pdf

https://publications.iadb.org/es/publications/english/viewer/Deep-Tech-The-New-Wave.pdf

https://www.reuters.com/technology/ai-company-runway-valued-15-bln-latest-funding-source-2023-06-29/

https://indicelatam.cl/home-en-2024/