LATAM's Best Kept Secrets in Deep Tech: Spacetech, Cleantech and Medical Devices

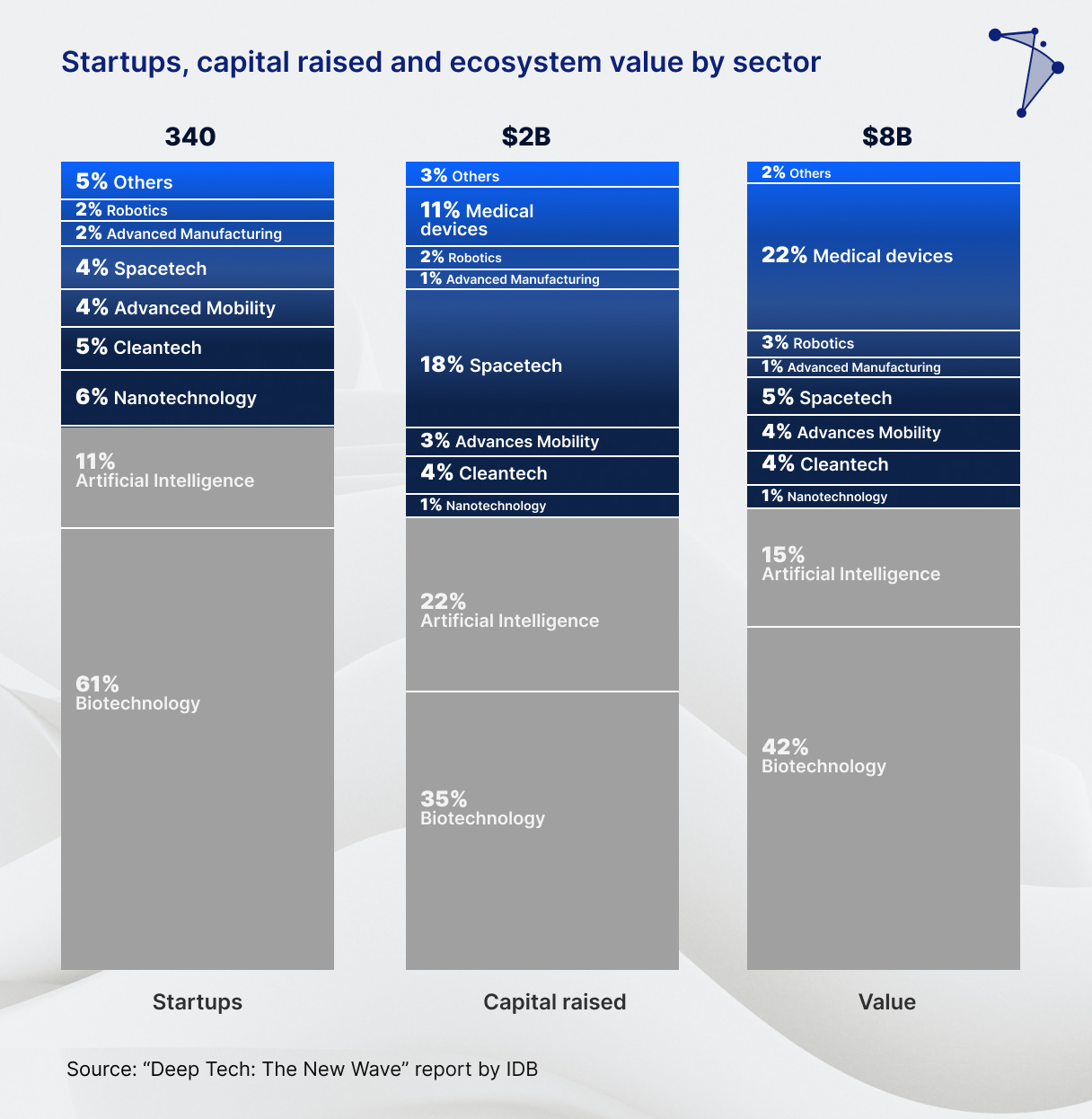

So far at LADP, we’ve covered biotech and AI in depth, the two biggest Deep Tech verticals in LATAM. Together, these sectors represent 72% of Deep Tech startups in the region that have secured over $1 million in institutional funding, 57% of the capital raised and also 57% of the value created in the region.

Everyone talks about AI and Biotech, but misses another wave of businesses that are contributing to the region’s technical development and scaling globally. Nanotechnology (6% of startups), cleantech (5%), spacetech (4%), advanced mobility (4%), robotics (2%), advanced manufacturing (2%), healthtech (2%), advanced materials (1%), and Others (5%) collectively account for 28% of the Deep Tech ecosystem. Despite their smaller representation, these sectors are achieving notable success in terms of capital raised, value creation, and impact delivered across the region.

For example, spacetech comprises only 4% of the startups that raised over $1 million between 2018 and 2023 in LATAM, yet it attracted 18% of the capital raised across all verticals–just a fraction lower than AI.

Similarly, medical devices, which also comprise a minimal number of startups in the region, contributed 22% to the value generated in the region–even more than AI!

In this blog we will examine these verticals of Deep Tech, analyze their presence in the region, and dive deeper in three of the leading startups across the verticals: spacetech, cleantech and medical devices.

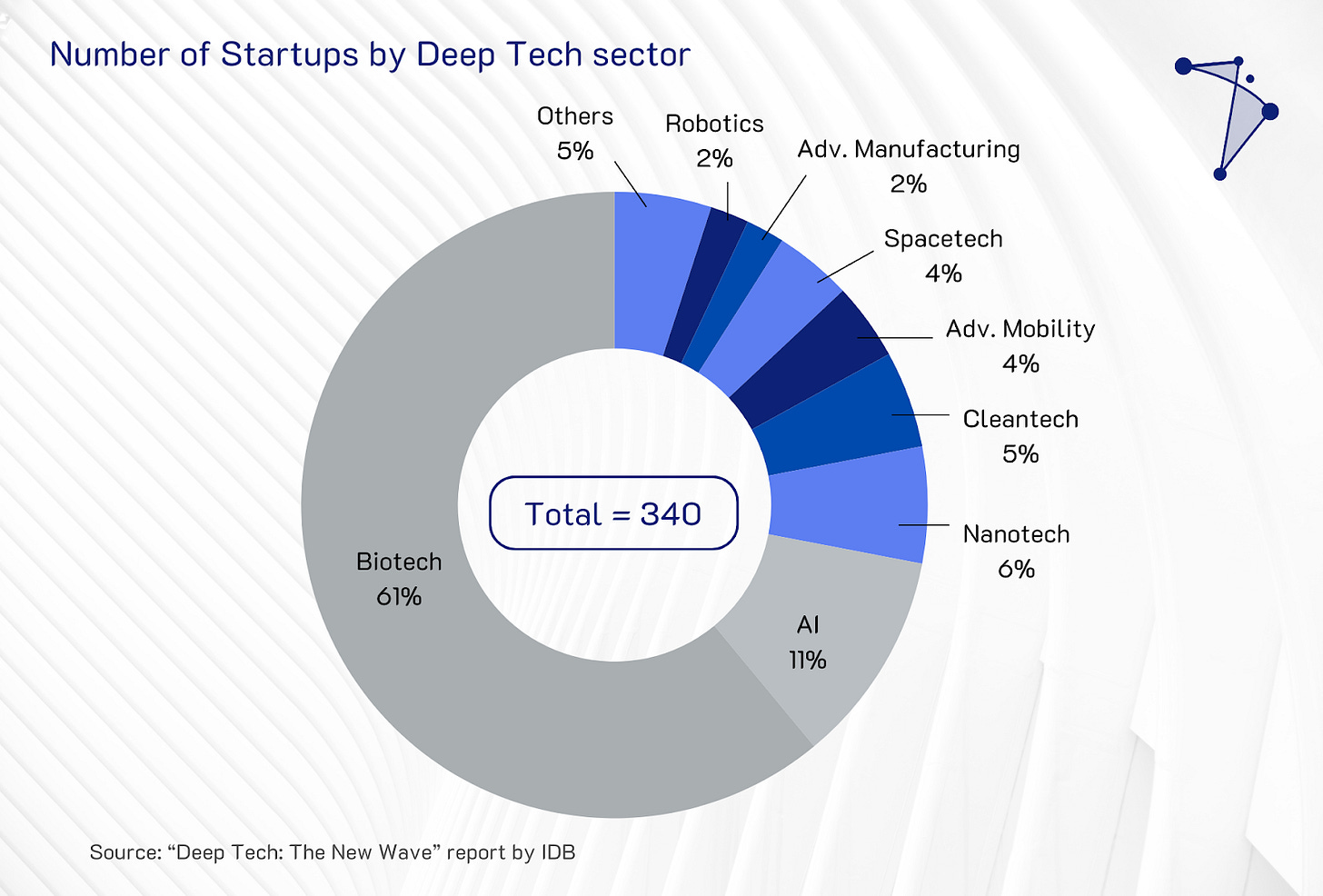

Number of startups by sector

Let’s take a closer look at each one of the segments outlined in the previous graph, starting with the number of startups founded beyond AI and biotech, which collectively represent 28% of LATAM’s Deep Tech ecosystem, comprising approximately 95 startups.

Beyond biotech and AI, which together account for 72% of all startups created, the distribution among smaller verticals is relatively even, ranging from 2% to 6% each.

Nanotechnology (6%) and cleantech (5%) emerge as the largest among these smaller categories.

For context, the United States alone is home to 1,148 nanotechnology startups, with 584 of them receiving funding—a stark contrast to the relatively modest presence of this sector in Latin America1.

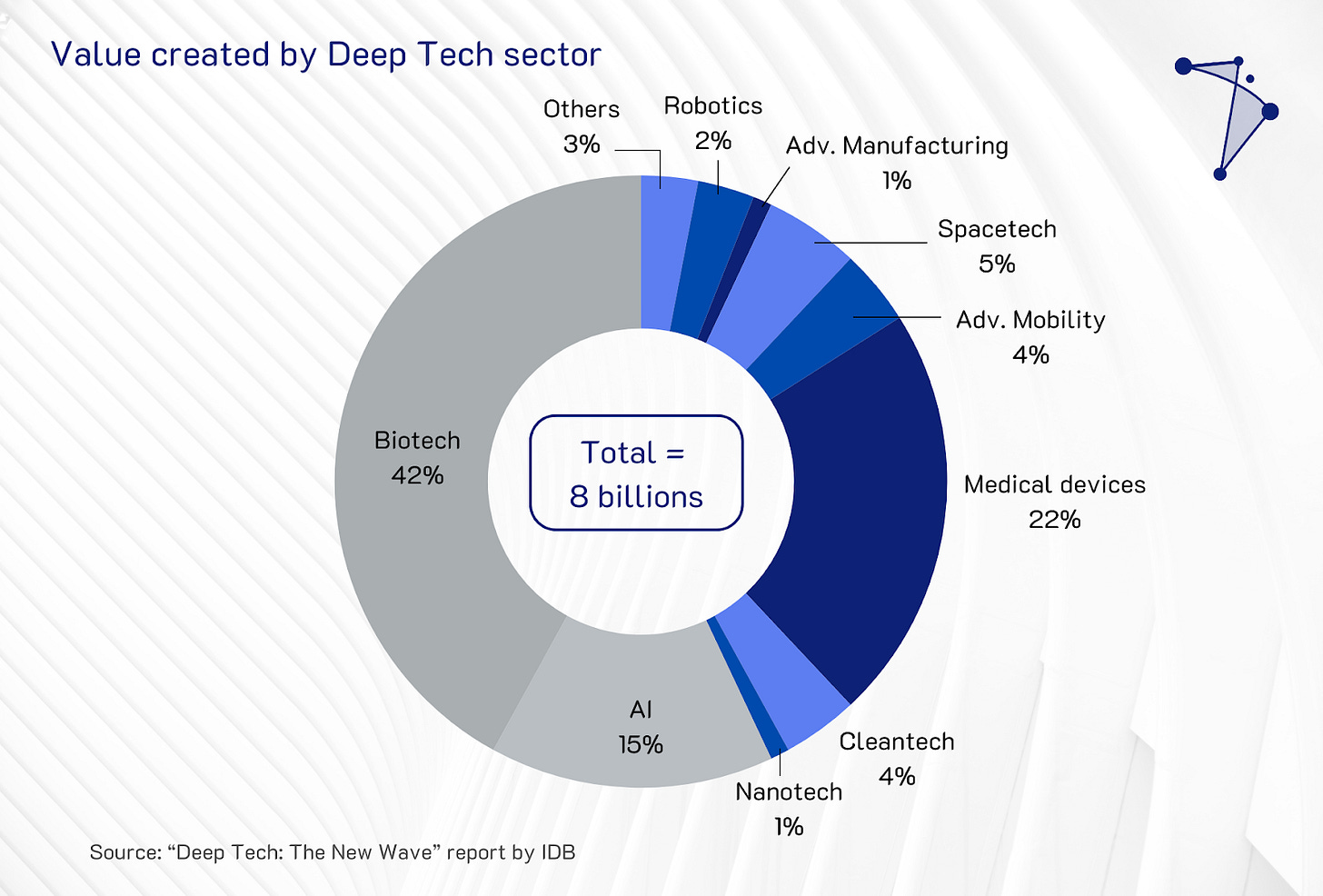

Value created by sector

The verticals beyond biotech and AI represent 43% of the $8 billion ecosystem value created by all Deep Tech startups, translating to approximately $3.44 billion.

All sectors are fairly balanced between 1% to 5% each, except for Medical Devices, which accounts for 22% of the total value of the ecosystem in LATAM.

The spike in Medical Devices is primarily due to Establishment Labs, the highest valued Deep Tech company in LATAM, at $1.8 billion alone.

These numbers may seem promising, but they are still a small fraction if compared to the global Deep Tech landscape:

The global medical devices market was valued at $520 billion USD in 2024, and is projected to reach $900 billion by 20332.

The global spacetech market was valued at $640 billion USD in 2023, and is projected to reach $1.5 trillion USD in 20353.

The global cleantech market was valued at $700 billion in 2023, and is projected to reach more than $2 trillion USD by 20354.

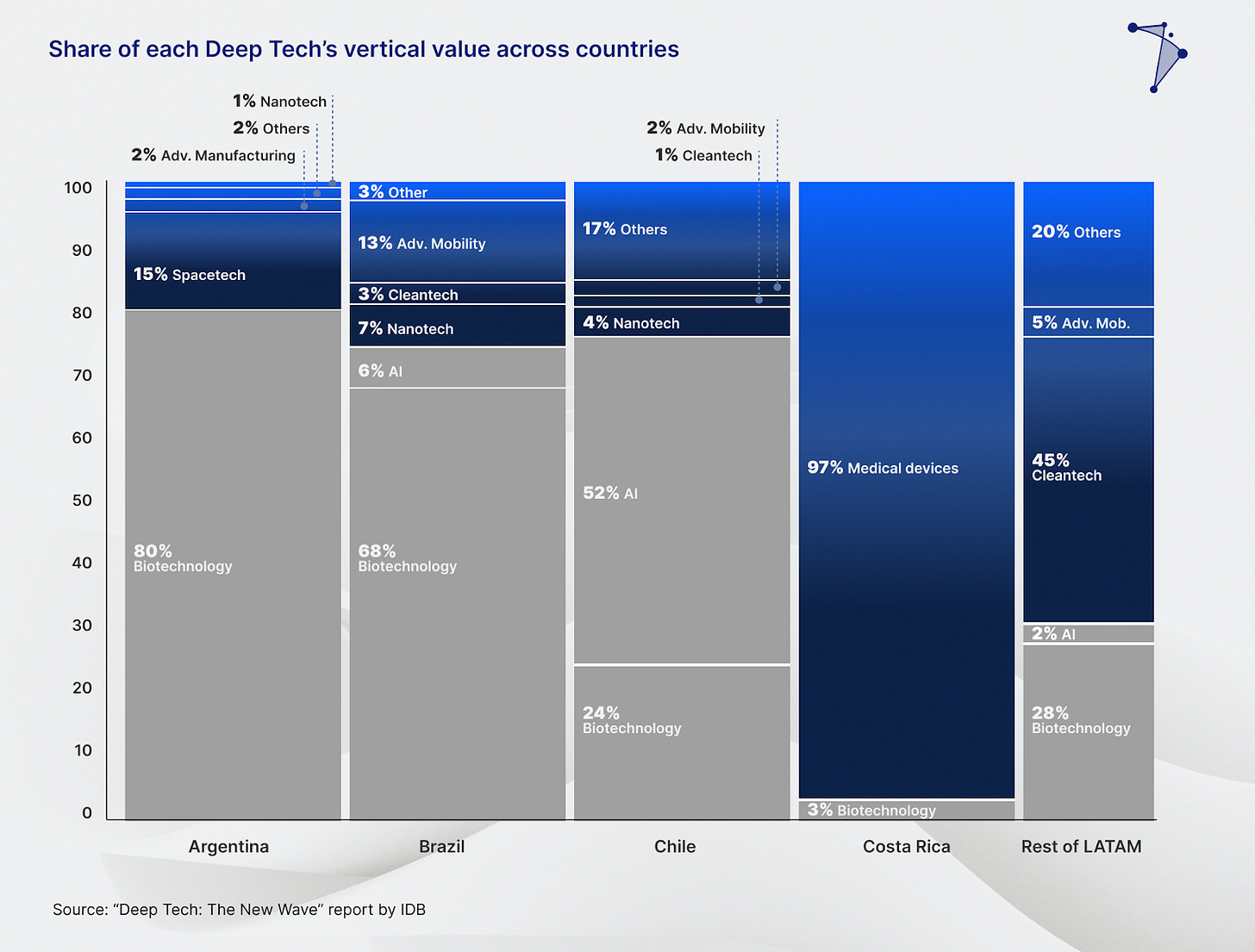

Share of each Deep Tech’s vertical value across countries

The Deep Tech: The New Wave report by the International Development Bank also includes a breakdown of value created by country, offering a more granular approach to the strengths and opportunities across LATAM.

Argentina's Deep Tech ecosystem outside of biotech and AI is led by spacetech (15%), All other verticals provide minimal contributions, of 2% or less each.

Brazil’s Deep Tech ecosystem outside of biotech is led by Advanced Mobility (13%) and followed by Nanotechnology (7%).

Chile’s Deep Tech ecosystem outside of biotech and AI is classified as Others (17%).

Costa Rica’s Deep Tech ecosystem outside of biotech and AI is dominated by Medical Devices, which represent a remarkable 97% of the value, while other sectors have negligible contributions.

In the Rest of LATAM, Cleantech stands out with 45% of the value created, followed by Medical Devices (20%), while the second major group is classified as Others (20%).

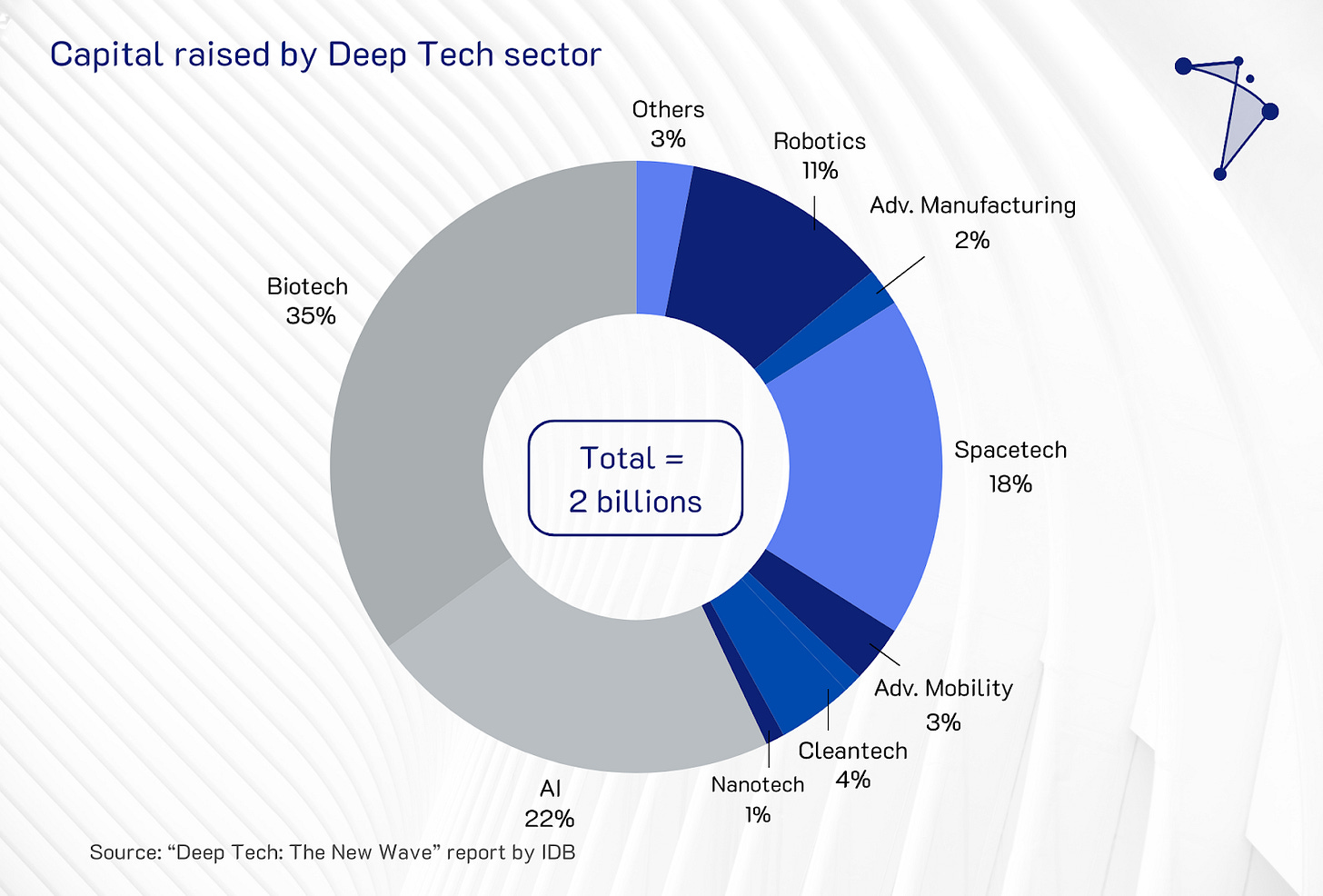

Capital raised by sector

Lastly, the verticals beyond AI and biotech captured 43% of the $2 billion raised by Deep Tech startups in LATAM, amounting to $860 million in total funding.

Of the $2 billion USD raised by Deep Tech startups between 2018 and 2023 in LATAM, Space Tech (18%) and Medical Devices (11%) lead the way, together accounting for nearly 30% of the total.

The spike in Medical Devices is primarily due to Establishment Labs.

Let’s consider the global capital raised in spacetech for context. SpaceTech Analytics estimated that North America dominates with $102 billion in investment, far outpacing Asia-Pacific's $42 billion. In contrast, South America lags significantly with only $750 million, highlighting a vast disparity in financial resources allocated to SpaceTech innovation across these regions5.

Leading Startups

Below, we profile 3 leading startups in spacetech, cleantech, and medical devices across LATAM, to have a clearer understanding of the diversity of initiatives and opportunities.

Satellogic (spacetech)

Founded in 2010 and headquartered in Buenos Aires, Satellogic focuses on building a scalable Earth Observation platform through a high-resolution Low Earth Orbit (LEO) satellite constellation. It aims to provide affordable geospatial data for various industries and governments at a competitive price point. It has developed a global presence with 34 operational spacecraft.

With total equity funding of $239M, Satellogic’s key investors include Liberty Strategic Capital, Tencent, and the Inter-American Development Bank. The largest funding round was $150M (Series D in 2022), and the latest was a $10M Post IPO round in December 20246.

It is among the nine Deep Tech companies valued between $100M and $500M, according to IDB.

Satellogic has received criticism recently, after it partnered with O.N.E. Amazon to develop an "Internet for Forests" in the Amazon rainforest. This initiative involves deploying sensors and satellite technology to monitor the forest, with the data collected being used to create digital asset securities representing hectares of the rainforest. Critics argue that this approach commodifies and tokenizes the natural ecosystem, potentially exploiting the Amazon and its indigenous communities under the guise of conservation7.

Sistema.bio (Clean Tech)

Founded by Alexander Eaton, who grew up in Kenya, alongside Mexican co-founder Camilo Pagés, Sistema.bio is a Mexico-based Clean Tech company that designs and implements biodigester solutions for sustainable waste management and renewable energy generation. The company aims to empower farmers and rural communities by providing affordable and scalable solutions to reduce greenhouse gas emissions and enhance agricultural productivity.

The company operates major hubs in Mexico and Colombia, and has full-service partnerships in Costa Rica, Peru, Nicaragua, Belize, the Dominican Republic, El Salvador, Guatemala, Uruguay, Ecuador, and Honduras. Additionally, demo installations are present in Haiti, Venezuela, and Cuba, reflecting a broad regional reach with varying levels of implementation and collaboration8.

Between 2024 and 2025, Sistema.bio raised $22.8M across three disclosed Series B funding rounds. Key funding milestones include $4.3M in July 2024, $15M in October 2024, and $3.5M in January 2025. Notable investors include KawiSafi, AXA Investment Managers, Blink, EcoEnterprises Fund, ElectriFI, Chroma Impact Investment, and Novastar Ventures.

With a valuation of $50M-$100M, Sistema.bio stands as a key player in the Clean Tech sector in Latin America.

Establishment Labs (Medical Devices)

Founded in 2004 and headquartered in Costa Rica, Establishment Labs is a medical technology company specializing in minimally invasive, next-generation breast implants under the Motiva Implants® brand. Their solutions focus on safety and aesthetics, with commercial distribution in over 70 countries. It holds 25 patents and 200 global patent applications across 25 jurisdictions.

Establishment Labs has raised $121M across eight funding rounds, with a $55M Series D round as its largest. Key investors include Madryn Asset Management, JW Asset Management, and Crown Predator Holdings. It is listed on NASDAQ and valued at $1.8B, making it the most valuable company in the regional ecosystem9.

In January 2025, founder and CEO Juan José Chacón-Quirós announced he would step down as CEO effective March 1, 2025, transitioning to a role on the board of directors to focus on innovation and market expansion. Peter Caldini, the current president, will serve as interim CEO10.

Conclusion

Despite accounting for only about a third of LATAM’s Deep Tech startups, sectors like Spacetech, Medical Devices, Nanotechnology, and Cleantech have demonstrated a significant impact, both in terms of capital raised and value created. These sectors are not only thriving locally but are also making strides in international markets, showcasing the region's capacity for global innovation.

Notably, Establishment Labs, the highest-valued Deep Tech company in LATAM, is publicly traded on NASDAQ and continues to attract international investment. Similarly, Sistema.bio has expanded its operations to 15 countries across the region, delivering sustainable solutions for renewable energy. Satellogic, with its cutting-edge space technology, has developed a global presence, serving industries and governments worldwide.

By leveraging their unique strengths and focusing on sustainable, scalable solutions, these emerging sectors are poised to make an outsized impact, positioning LATAM as a key player in global technological advancement.

About LADP

At LADP, we are working to identify, participate in, and foster Deep Tech networks of startups and builders across LATAM. Our mission is to address challenges related to institutional frameworks, education systems, infrastructure limitations, and market environment paradigms that currently hinder large-scale development by systematically adopting and implementing international best practices in the ecosystem.

https://tracxn.com/d/explore/nanotechnology-startups-in-united-states/__9PELeHgaPEJcB9x5HcZS-X9CoU_F2daTaVBLDwqvp8k/companies

https://www.globenewswire.com/news-release/2025/01/06/3004885/0/en/Medical-Devices-Market-To-Worth-Over-US-905-56-Billion-By-2033-Astute-Analytica.html

https://www.mckinsey.com/industries/aerospace-and-defense/our-insights/space-the-1-point-8-trillion-dollar-opportunity-for-global-economic-growth

https://www.iea.org/news/global-market-for-key-clean-technologies-set-to-triple-to-more-than-2-trillion-over-the-coming-decade-as-energy-transitions-advance

https://www.spacetech.global/spacetech-industry-in-figures

https://platform.tracxn.com/a/d/company/IjPj3pwEGe0oAoUo6Ksk9T-D8Wvy8jIEYRD5dscKViE/satellogic.com

https://unlimitedhangout.com/2024/08/investigative-reports/sustainably-surveilling-and-tokenizing-nature-the-case-of-o-n-e-amazon/?s=31

https://platform.tracxn.com/a/d/company/S8vT0mh4M_2ZHhPHT1fOEnjyZhDhB9hyARYnGDWWFfQ/sistema.bio#a:competitors

https://platform.tracxn.com/a/d/company/ifkorT0iUiz272opf41ykeNlvtslUvnpfy3V6WaMZLU/establishmentlabs.com#a:exits

https://investors.establishmentlabs.com/press-releases/press-releases-details/2025/Establishment-Labs-Announces-CEO-Transition/default.aspx